Balancing risk and return in your investment portfolio feels a lot like walking a tightrope. You’re aiming to get the best returns without risking too much of your hard-earned cash. It’s a tricky but essential part of investing.

First off, knowing your risk tolerance is crucial. It’s basically about how much you’re okay with potentially losing. If the thought of losing money keeps you up at night, then safer, low-risk investments might be your best bet. But, if you’re up for a bit of a gamble in hopes of higher returns, then riskier investments could be the way to go.

Your investment timeline matters too. For long-term goals, like saving for retirement, you’ve got time to ride out market ups and downs, allowing you to take on more risk. If you’re going to need your money sooner, being more conservative makes sense.

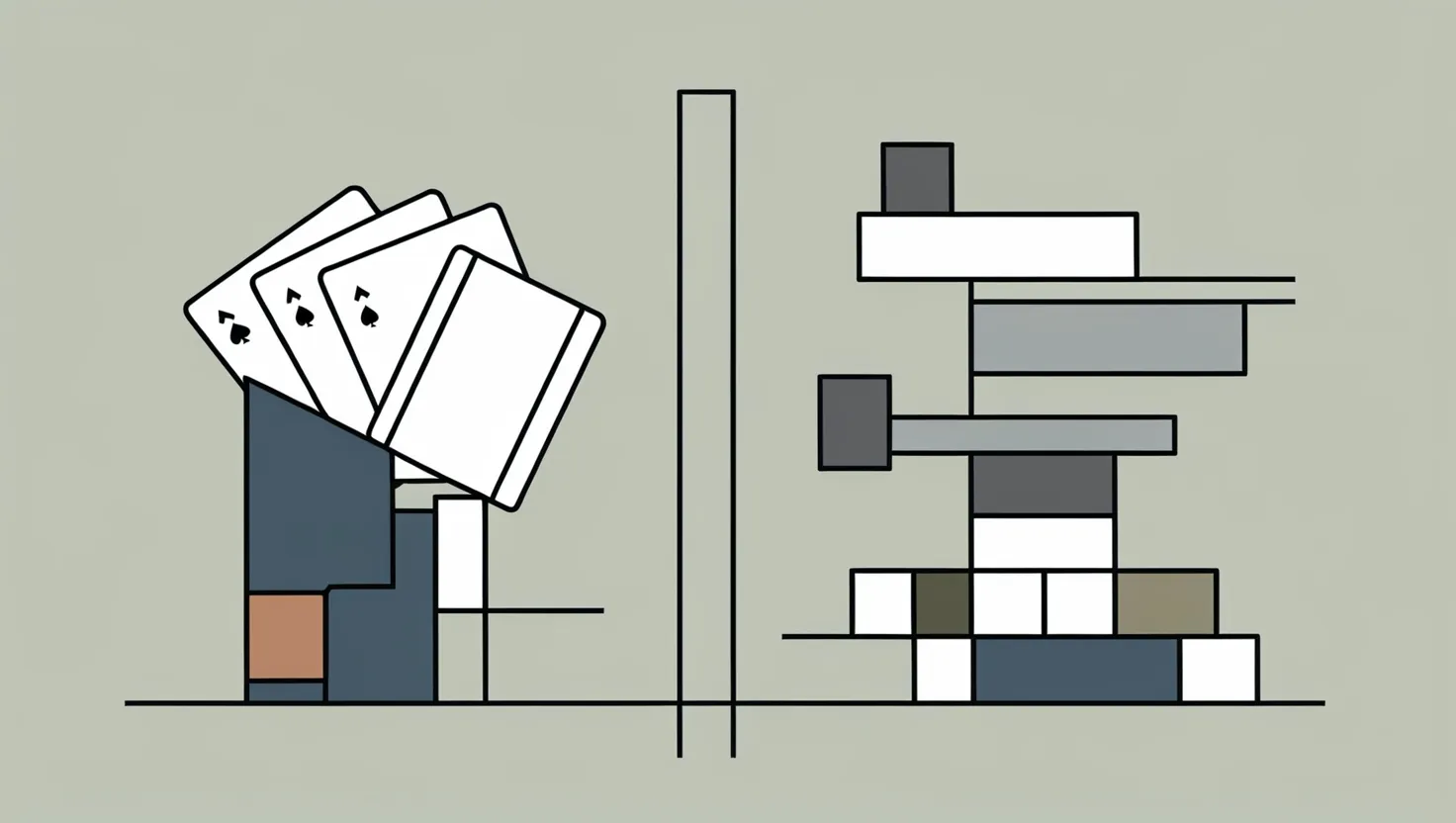

Diversification is a big deal. Spread your investments across different assets – think stocks, bonds, real estate, and maybe even some alternative investments like art or crypto. This way, a bad performance in one area can be offset by gains in another.

There’s a common strategy known as the “60/40” rule, where you put 60% of your money in stocks and 40% in bonds. Stocks might be riskier but offer higher returns. Bonds are generally safer but with lower returns. This mix helps balance growth and stability.

Another smart tactic is using the “efficient frontier” theory from Harry Markowitz. It’s all about figuring out the best returns for a given level of risk, finding that sweet spot.

Index funds or ETFs are also worth considering. They follow a market index like the S&P 500, offering wide diversification with little fuss. They tend to be less risky than picking individual stocks and can provide steady returns.

If you’re feeling adventurous, you might look at alternative investments like real estate or private equity. These can offer higher returns but come with higher risks. They also tend to be less tied to the stock market, giving you a bit of protection against market downturns.

Don’t forget to regularly rebalance your portfolio. As the value of your investments changes, your portfolio can become unbalanced. Rebalancing keeps everything in line with your risk tolerance and goals.

Lastly, keep an eye on interest rates. Higher rates can make bonds more attractive, and lower rates might push you towards stocks. Staying informed about these shifts can help you make better decisions.

In a nutshell, balancing risk and return is about knowing your financial situation, diversifying smartly, and regularly tweaking your strategy. With a thoughtful approach, you can aim for the best returns while keeping risks in check.