Dollar-cost averaging is this really cool investment trick that keeps things simple and reduces stress, especially when the market’s all over the place. Here’s how it works: you regularly invest a fixed amount of money, no matter what the market is doing.

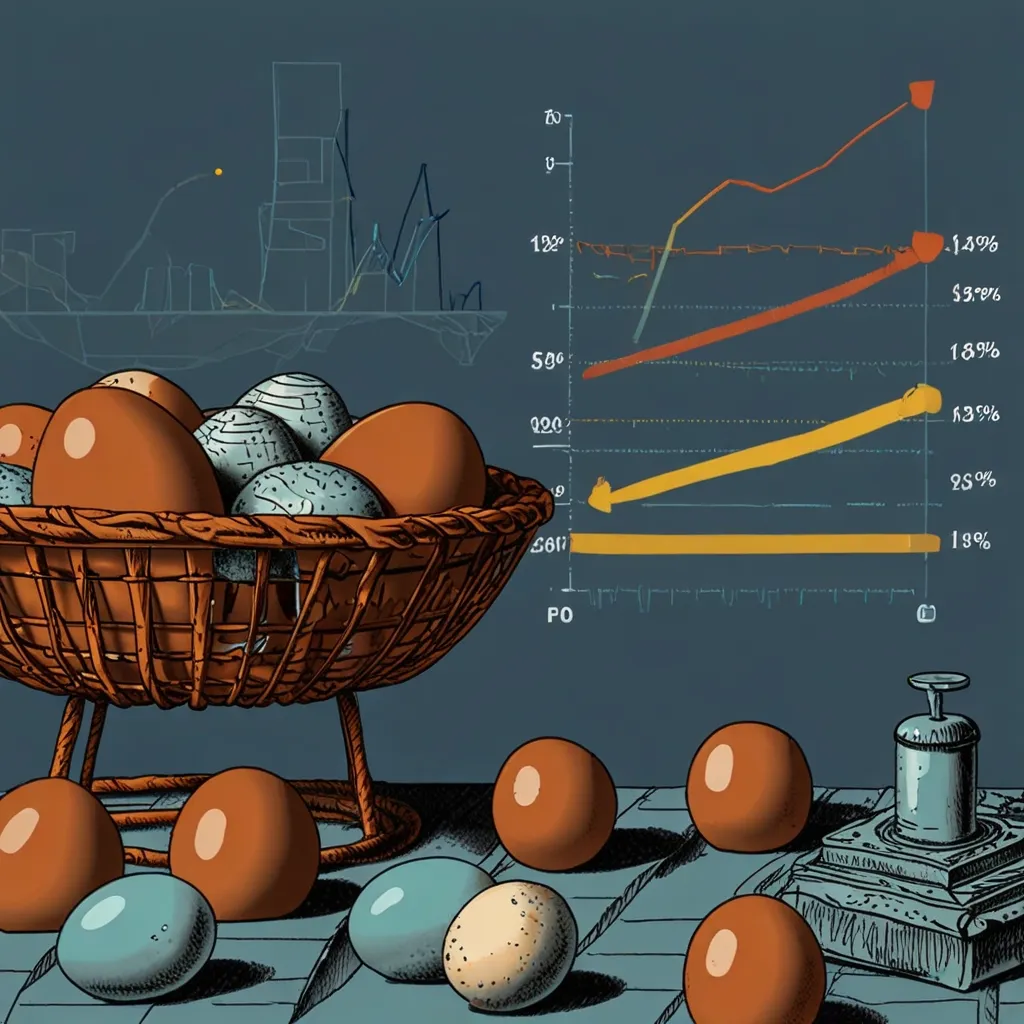

Think about setting aside a certain amount of money to invest each month. With dollar-cost averaging, you’d invest that same amount consistently. When prices are low, you buy more shares. When prices are high, you buy fewer. Over time, this can actually lower your average cost per share, making your investments way more efficient.

Let’s break it down. If you’re putting in $100 each month, when the market is up and shares are $5, you’ll snag 20 shares. When the market dips and shares drop to $2, your $100 will fetch you 50 shares. This way, you’re getting more bang for your buck when prices are low, balancing out your overall investment costs.

This strategy is fantastic for beginners dipping their toes into investing. It helps build a regular investing habit and takes some of the risk out of trying to time the market. Even seasoned investors dig it because it takes the guesswork out of picking the perfect moment to invest.

One of the best parts? It keeps you from riding the emotional rollercoaster of market highs and lows. By sticking to a fixed investment amount, the ups and downs of the market won’t mess with your head as much. It’s also perfect for long-term goals since it doesn’t require you to constantly keep an eye on the market.

Of course, it’s not flawless. If the market’s steadily climbing, putting in a lump sum at the start might give you better returns. And in a sinking market, it won’t shield you from losses. So, do your homework and pick solid investments because this strategy doesn’t substitute for smart decision-making.

Getting started is super easy. Just set up an automatic investment plan with your brokerage, and your fixed amount will be invested at regular intervals, like monthly or bi-weekly. Most brokerages offer this feature, making dollar-cost averaging a breeze.

In a nutshell, dollar-cost averaging spreads your investments out over time, helping you dodge market timing risks, stay cool during market swings, and potentially lower your average share cost. Whether you’re new to investing or have been at it for years, this strategy could be a handy addition to your investment toolkit.