Getting a handle on debt is super important if you want to reach financial stability and peace of mind. Not all debt is doom and gloom—some can even help you build wealth, while others can drag you down. Let’s walk through some easy tips and tricks to manage your debt better.

First up, check out your finances. Make a list of everything you owe, including those pesky interest rates. This way, you can see which debts are hurting you the most. High-interest credit card debt should be your main focus because it can get out of hand quickly.

Next, take a peek at your credit report. You can grab a free copy from one of the big three credit-reporting agencies. This helps make sure you’re not overlooking any debts and might even catch some errors or sketchy accounts. Your credit score matters—it can influence your ability to get future loans or credit cards.

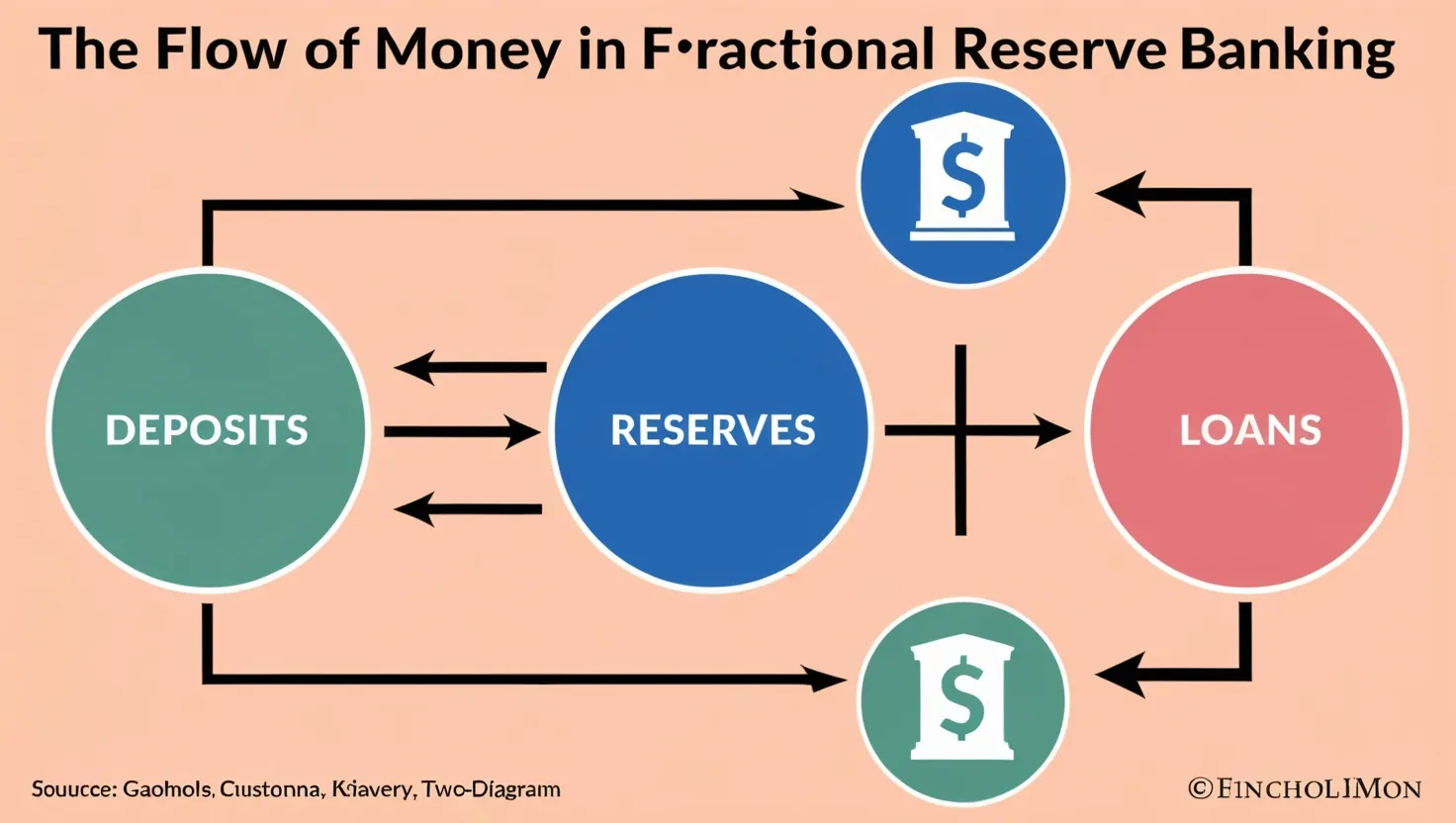

If you’re juggling multiple high-interest loans, debt consolidation could be your new best friend. Look for a low-interest personal loan or a credit card to pay off those high-interest ones. For instance, if you’ve got a bunch of credit cards with high rates, rolling them into one lower-interest loan can save you cash over time.

Taking a hard look at your spending is also key. When debt feels overwhelming, cutting out unnecessary expenses can make a big difference. Find spots where you can save and put that extra cash towards paying down your debt. Remember, reducing debt is all about minimizing new debt too.

Once you’ve consolidated your debt, work out your monthly payments. Fit these payments into your budget to see if you can handle them easily. If it’s too much, you might need to chat with your lenders to get better terms.

After locking down your minimum payments, think about how much extra you can throw at your debt each month. Trimming expenses can free up more money for this. That little extra can speed up your debt payoff journey a lot.

There are two popular ways to pay off debt: the snowball method and the avalanche method. The snowball method involves knocking out your smallest debts first to gain some momentum. The avalanche method, on the other hand, targets high-interest debts first to save more over time. Pick whichever method fits you best.

It’s also smart to know the difference between good debt and bad debt. Good debt, like mortgages or student loans, can help you build wealth or up your earning potential. Bad debt, like credit card debt or car loans, can drain your finances before you know it. Try to steer clear of bad debt when you can.

For example, a mortgage can eventually help you own a home that might appreciate in value. A student loan can lead to a better-paying job. But using a credit card for things like clothes or electronics usually spells bad debt since these items lose value fast and don’t offer long-term benefits.

In a nutshell, managing debt effectively means knowing your financial situation, consolidating your debts, cutting back on the extras, and picking the right payoff strategy. Follow these steps and dodge bad debt to take control of your finances and head towards a debt-free life.