Apple is undeniably the most influential American company. From the widespread presence of their gadgets to the nearly obsessive loyalty of their customers, it’s no wonder Apple was the first U.S. company to hit a trillion-dollar valuation. But rewind twenty years, and the story was starkly different. Apple was on the brink of collapse, and surprisingly, it wasn’t Steve Jobs who threw them a lifeline—it was Microsoft.

The Apple of 1997 was a struggling computer company. Smartphones weren’t even a thing yet. Their computers, while enjoying good profit margins, fell short in popularity due to their exorbitant prices. Apple’s refusal to license its operating system to other manufacturers worked against them as businesses flocked to Microsoft, which had captured about 90% of the market. At that time, software choices were critical, and Apple’s limited market share made it difficult to attract developers.

Steve Jobs wasn’t even part of Apple then. He had been ousted in 1985. But in a desperate bid to save the company, Apple’s board brought him back in 1997 when they acquired NeXT, the company Jobs founded post-Apple. However, money was tight, so Jobs was paid in Apple shares. By July 1997, Apple had less than 90 days’ cash in the bank and was valued below $3 billion, having lost over a billion dollars that year.

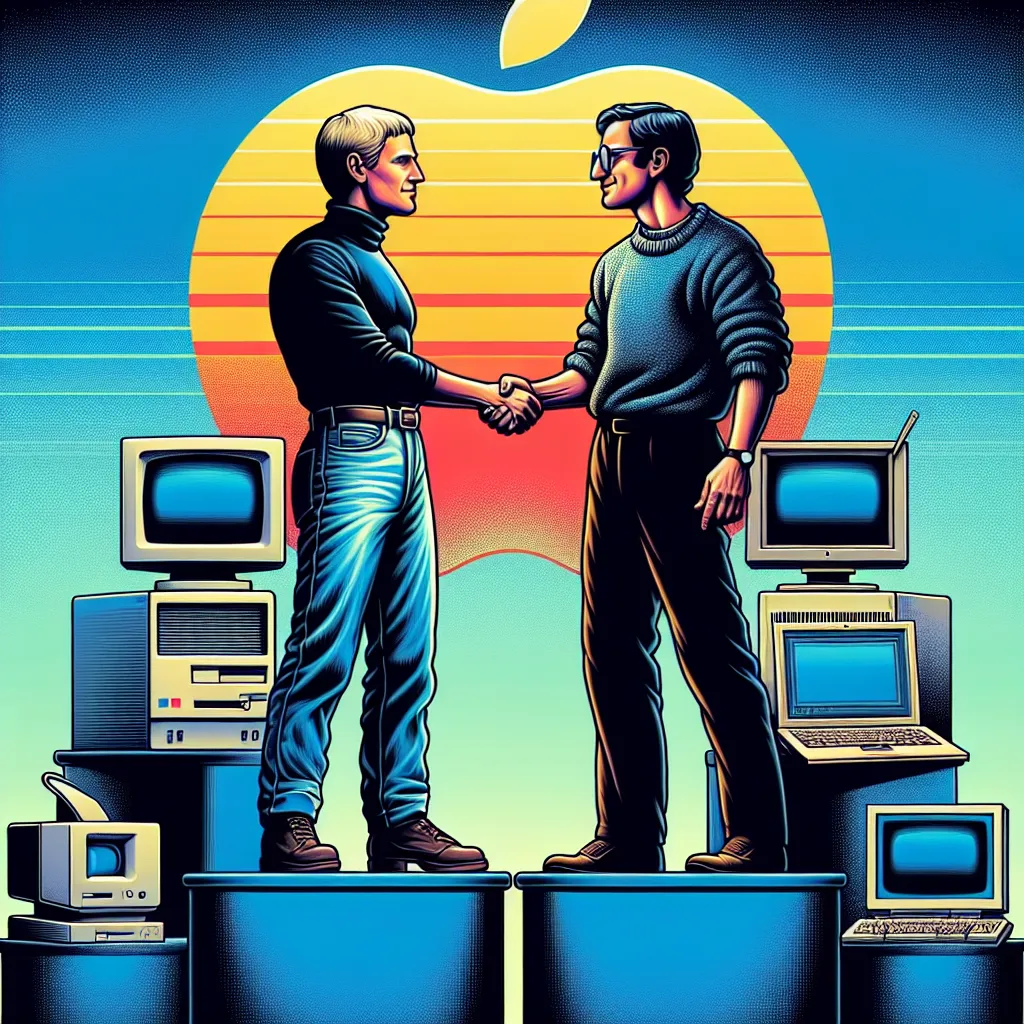

Then came the shocker in August 1997: Steve Jobs announced a partnership with Microsoft. The crowd’s reaction was mixed. How could Apple join forces with the very company driving them out of business? To top it off, Apple declared Internet Explorer as the default Macintosh browser. But Microsoft had more to offer. They invested $150 million in Apple and promised to keep Microsoft Office on Mac for five years. This move was crucial since the availability of Office was a deal-breaker for many potential Apple customers.

So why did Bill Gates, known for his fierce business tactics, help Apple? The 1990s saw Microsoft under the antitrust microscope, and propping up Apple could deflect those monopoly accusations. And indeed, by sparing Apple from demise, Gates indirectly safeguarded Microsoft from a breakup by regulators.

After the partnership, Gates sold the Apple shares as soon as they fulfilled their purpose, netting 18.2 million shares, which he sold in 2003. If he had held on, those shares would be worth a mind-boggling $53.5 billion today. Nonetheless, Gates’ decision was strategic, helping both companies navigate tricky regulatory waters.

Apple’s story of revival is a testament to unexpected partnerships and strategic decisions. From near bankruptcy to a trillion-dollar titan, their journey underscores the unpredictable nature of business.