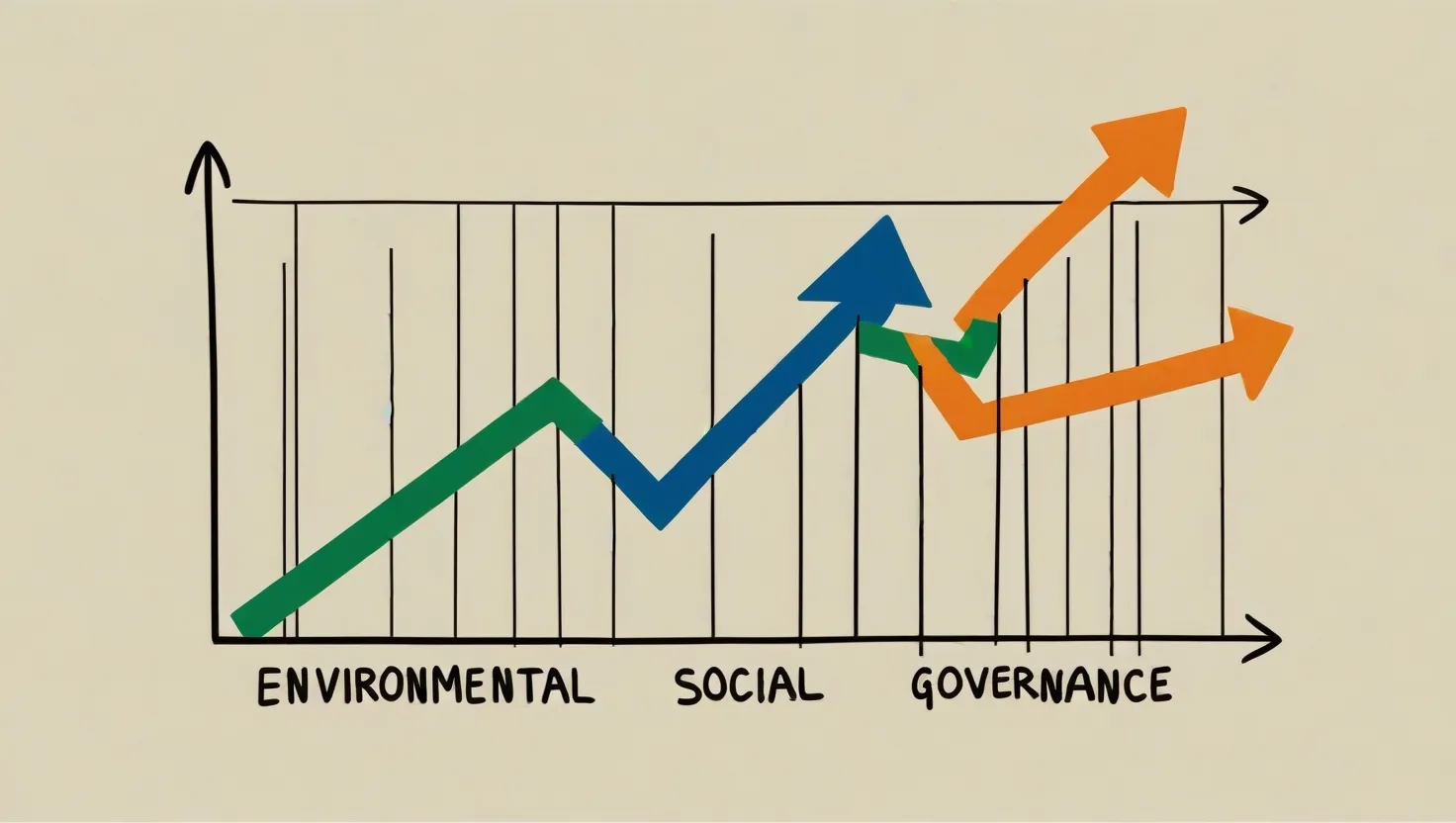

As we step into 2024, the financial landscape is undergoing a significant transformation, and at the heart of this change is the rise of ESG (Environmental, Social, and Governance) investing. What was once a niche concept has now become a mainstream strategy, influencing not just investment decisions but also the way corporations operate and governments regulate.

To understand the magnitude of this shift, let’s go back to the origins. The term “ESG” was first coined twenty years ago by UN Secretary General Kofi Annan in a landmark study titled “Who Cares Wins.” This report laid the groundwork for what would become a global movement, urging investors to consider more than just financial returns when making investment decisions.

Fast forward to today, and it’s clear that ESG has become an integral part of the investment ecosystem. Investors are no longer content with just looking at the bottom line; they want to know how their investments are impacting the environment, society, and corporate governance. This shift is driven by a growing awareness of the interconnectedness of financial and non-financial performance.

One of the most significant trends in ESG investing is the increased focus on private debt fundraising for sustainability initiatives. As companies strive to meet ambitious net zero targets, they are turning to private debt as a more stable and less risky alternative to equity-based funding. This has led to a surge in demand for data and software solutions that can track ESG performance across private asset portfolios. Companies like MSCI, with its carbon footprint modeling tools, and AtomInvest, which helps credit managers monitor ESG metrics, are at the forefront of this movement.

The impact of ESG on corporate behavior is profound. Companies are rapidly adopting or strengthening their ESG strategies to attract investors and access capital. This is not just about compliance; it’s about demonstrating a commitment to sustainability and responsible governance. The market volatility of recent years has highlighted the importance of ESG as a risk management tool. Investors have turned to ESG funds as a way to safeguard against market downturns, and this has had a domino effect on corporate adoption of ESG practices.

However, the journey is not without its challenges. One of the criticisms of ESG metrics is the lack of standardization and transparency. Greenwashing, where companies exaggerate their environmental credentials, is a significant concern. To address this, there is a growing push for enhanced governance policies and increased regulatory oversight. For instance, the European Union’s Green Deal Industrial Plan and the U.S. Inflation Reduction Act are setting new benchmarks for sustainability reporting and disclosure.

Despite these challenges, the future of ESG investing looks promising. Global policy decisions and regulatory changes are creating a more enabling environment for sustainable investing. The focus is shifting from commitments to implementation, with companies being held to account for their decarbonization progress. This is not just about meeting regulatory requirements; it’s about creating long-term value.

Investors are also becoming more sophisticated in their approach to ESG. Instead of blanket negative screens, many are adopting nuanced strategies that focus on improving issuers and supporting companies that are actively shifting towards more sustainable practices. This includes investing in green, social, and sustainability bonds, as well as engaging with companies to drive positive change.

The energy transition is a key area where ESG investing is making a significant impact. The need to accelerate the reduction in carbon emissions is driving investment in clean energy technologies, electric vehicles, and grid infrastructure. European companies are at the forefront of this transition, with nearly 70% of companies that have set or committed to science-based targets based in G20 countries, and over half in Europe.

The economic benefits of ESG investing are also becoming clearer. Decarbonization can be net positive for returns, as companies that lead in the energy transition are likely to reap both climate and economic benefits. The policy-backed reallocation of capital towards innovative climate technologies is creating new investment opportunities and driving growth.

As we look ahead to the rest of 2024, it’s evident that ESG investing is here to stay. It’s no longer a niche concept but a central part of the financial landscape. The challenges ahead will include accurately pricing climate and nature risks, developing more robust market standards, and ensuring that companies deliver on their sustainability commitments.

For investors, the message is clear: ESG is not just a moral imperative but a financial necessity. It’s about managing risk, driving long-term value creation, and contributing to a more sustainable future. As the world continues to grapple with the complexities of climate change, social inequality, and governance issues, ESG investing stands as a beacon of hope – a testament to the power of finance to drive positive change.

In this evolving landscape, one thing is certain: the future of finance is sustainable, and ESG is at its core. As we navigate this new era, it’s crucial to keep in mind that sustainability is not just an add-on but an integral part of how we invest, how companies operate, and how we build a better future for all.