Aviation is a huge part of our lives. Nearly 10 million people hop on more than 100,000 flights every day. Along with them, goods worth $17.5 billion are flown worldwide daily. One of the key players in this field is Boeing, the largest aircraft manufacturer globally. Let’s dive into their story.

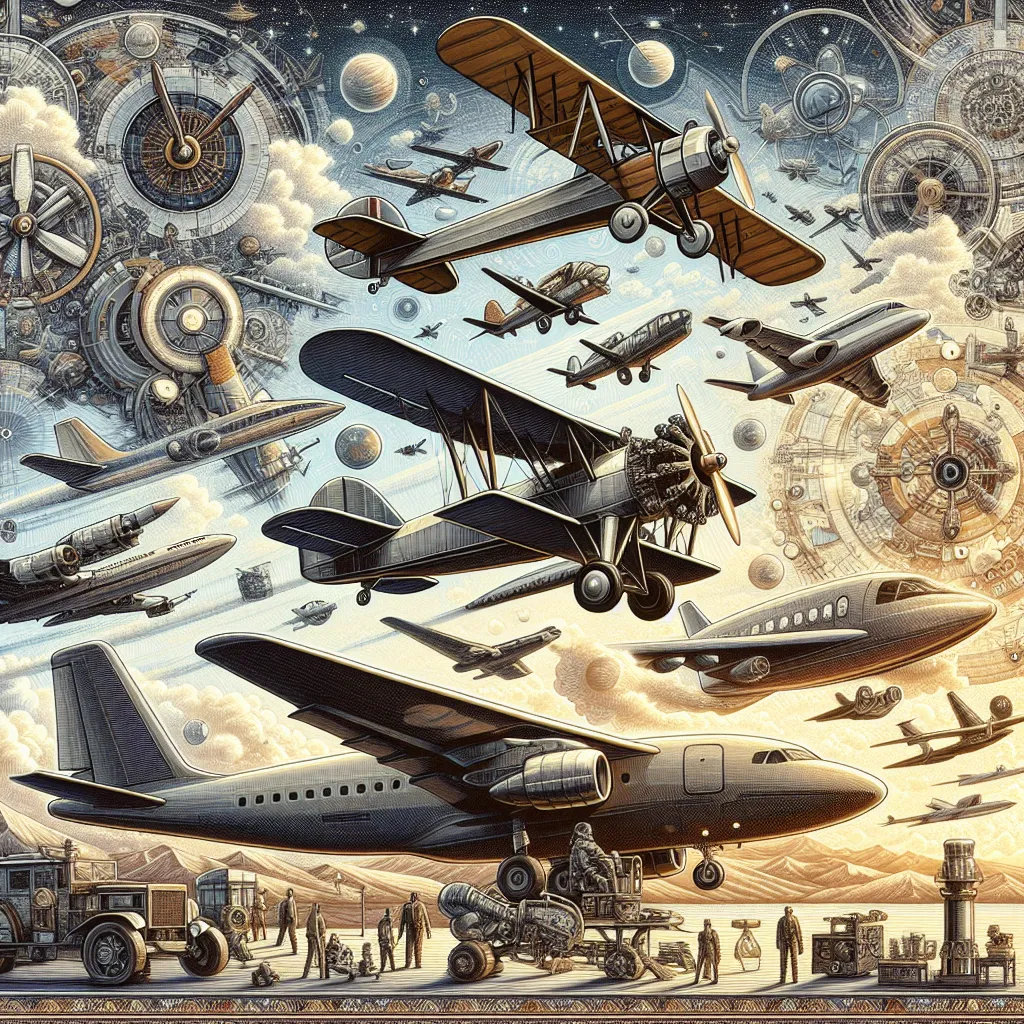

At the turn of the 20th century, travel was expensive and time-consuming. Most people used horses for transportation, with only the rich affording early automobiles. The Wright brothers changed the game on December 17, 1903, with their first successful flight of a heavier-than-air aircraft. This set the stage for the rapid advancement of aviation technology.

Enter William Boeing, a young entrepreneur who saw the immense potential in aviation. With an engineering degree from Yale and a successful logging business, William had the means to explore his interests, including aviation. In 1914, he took his first airplane flight and loved it so much that he started taking flying lessons. He then bought a Martin TA floatplane and partnered with his friend, George Westervelt, to create an improved design.

In 1916, William incorporated the Pacific Aero Products Company, and their first model, the Bluebill, was born. When the U.S. entered World War I in 1917, there was a huge demand for military aircraft. William renamed the company Boeing and rolled out innovations like the Model C, which impressed the U.S. Navy. By 1918, Boeing expanded massively, with orders pouring in.

After World War I, demand plummeted, leading Boeing to repurpose its factory to make furniture. But the company bounced back with military contracts and continued innovation. In the 1920s, Boeing tried its hand at commercial aviation and entered the airmail business. By the end of the decade, Boeing held a near-monopoly in aviation.

The 1930s saw Boeing leading the commercial air travel boom despite the Great Depression. Innovations like the Boeing 247 and later the iconic B-17 Flying Fortress bomber during World War II solidified Boeing’s status. The post-war years brought challenges but also groundbreaking aircraft like the B-29 Superfortress.

The Cold War era saw Boeing stepping into aerospace, developing missiles and entering the space race. Boeing’s commercial jets like the Boeing 707, 737, and 747 revolutionized air travel. The oil crisis of the 1970s and emerging competitors like Airbus strained Boeing, but military contracts kept it afloat.

By the 1990s, Boeing had acquired McDonnell Douglas, further strengthening its position. The Boeing 777 became a noteworthy success. In the 21st century, Boeing expanded into satellite communications and cybersecurity and continued its association with NASA, facing stiff competition from SpaceX in the new space race.

Boeing’s journey from a small startup to a global aerospace giant is a tale of innovation, resilience, and strategic pivots. Despite the challenges, Boeing remains a cornerstone of the aviation and aerospace industry, competing fiercely in both realms.