Imagine standing in a crowded marketplace thousands of years ago, sheep in one hand, a sack of grain in the other, trying to find someone willing to trade what you have for what you need. That’s how commerce began for our ancestors—imperfect, unpredictable, and always a negotiation. As I reflect on how far we’ve come, it’s almost staggering how payments, once so tangible and personal, have been transformed by our pursuit of simplicity and trust.

Many people assume that the barter system was merely a bridge to coins and paper, but what’s overlooked is how inventive early societies became when direct swaps didn’t work. Some communities used shells, others salt, and even cacao beans held sway across civilizations as a kind of proto-currency. These choices weren’t random. They reflected what a group valued, what was scarce, and what could be carried without too much trouble. Imagine having to decide between a basket of olives or a small, shiny bead as your week’s wages. What would you prefer?

The move to metal coins eventually changed the game. The first coins, struck around 600 B.C., delivered a breakthrough not because they were precious, but because everyone agreed on their value and could recognize them at a glance. Still, they were heavy, easy to steal, and the supply was limited by how much precious metal a region could mine or loot. Even the earliest coins were counterfeited, and rulers constantly worried about shaving the edges or mixing in worthless metals. This shadow of fraud has followed every payment system since—a reminder that convenience and trust are forever linked.

When paper money emerged in China over a thousand years ago, it was less about carrying cash and more about reshaping belief. Early banknotes promised their holder redemption in coin—if the issuing authority was honest and solvent. What if they weren’t? The risks were real, especially since many early notes came from private entities, not central governments, and the line between banking and gambling was often blurred.

“Money is a matter of functions four, a medium, a measure, a standard, a store.” This old rhyme, attributed to economists for generations, captures how money’s duties have multiplied with its forms. Each new payment method has tried to solve for one or more of these needs, but rarely all at once.

Cheques might sound quaint now, but when they emerged in 17th-century London, they were revolutionary. Imagine being able to move large sums across distance—without carrying anything more than a signed slip of paper. Cheques allowed for a new kind of commerce but depended on networks of trust and centralized clearinghouses. Everyone worried about bounced cheques, forgeries, and the time it took for funds to clear. Even today, the phrase “the cheque’s in the mail” still evokes skepticism.

Fast forward to the telegraph age, and suddenly the world felt smaller. Electronic fund transfers, first through telegraph lines and later via telex and computers, sped money around the globe. The birth of systems like SWIFT and ACH meant businesses didn’t have to wait days or weeks; transactions could clear in hours or less. But speed created new headaches—errors traveled just as fast, and criminals were quick to exploit weak links.

Credit cards, which seem so routine now, were a truly radical idea in the 1950s. For the first time, you could buy now, pay later, and carry just a slim rectangle of plastic. The growth of credit cards sparked a wave of innovation in retail, travel, and even lifestyle. People stopped carrying fat wallets and started thinking in terms of credit limits, points, and purchase protection. This shift also fueled another industry: fraud detection and cybersecurity.

Debit cards soon followed, linking directly to bank accounts and putting an end to waiting days for cheques to clear. But as payment options multiplied, so did the complexity. Just think—how many plastic cards do you have in your wallet right now? And could you imagine explaining this to someone from the 1800s?

Then came the internet, and with it, yet another leap. Online payments transformed how we shop, work, and relate. Suddenly, a small business owner could sell goods worldwide without ever meeting a customer in person. Payment gateways made it possible to move money securely at the click of a button. You probably remember the first time you entered your card number online, wondering if your information was really safe.

Mobile payments and digital wallets represent the latest chapter in this ongoing story. Now, smartphones are more than just communication tools—they’ve become personal banks, payment terminals, and even currencies. You can pay for coffee with a tap, split a bill with friends through an app, or send money to family across continents in seconds.

But each advance brings its own set of challenges. The conveniences of today are built atop vast digital infrastructures that are only as strong as their weakest lines of code. Privacy concerns, data breaches, and relentless cyberattacks make headlines regularly. If paper money required trust in a central bank, digital wallets demand trust in a global web of software developers, telecom giants, regulators, and untested algorithms.

“The lack of money is the root of all evil,” Mark Twain quipped, but the truth is, the forms money takes shape our very societies—who gets included, who gets left out, and who gets rich. And as payment options have multiplied, so has financial exclusion for those without access to technology or proper identification. Isn’t it sobering that in a world of near-instant payments, billions still rely on cash or barter because they lack the documents or devices required for newer methods?

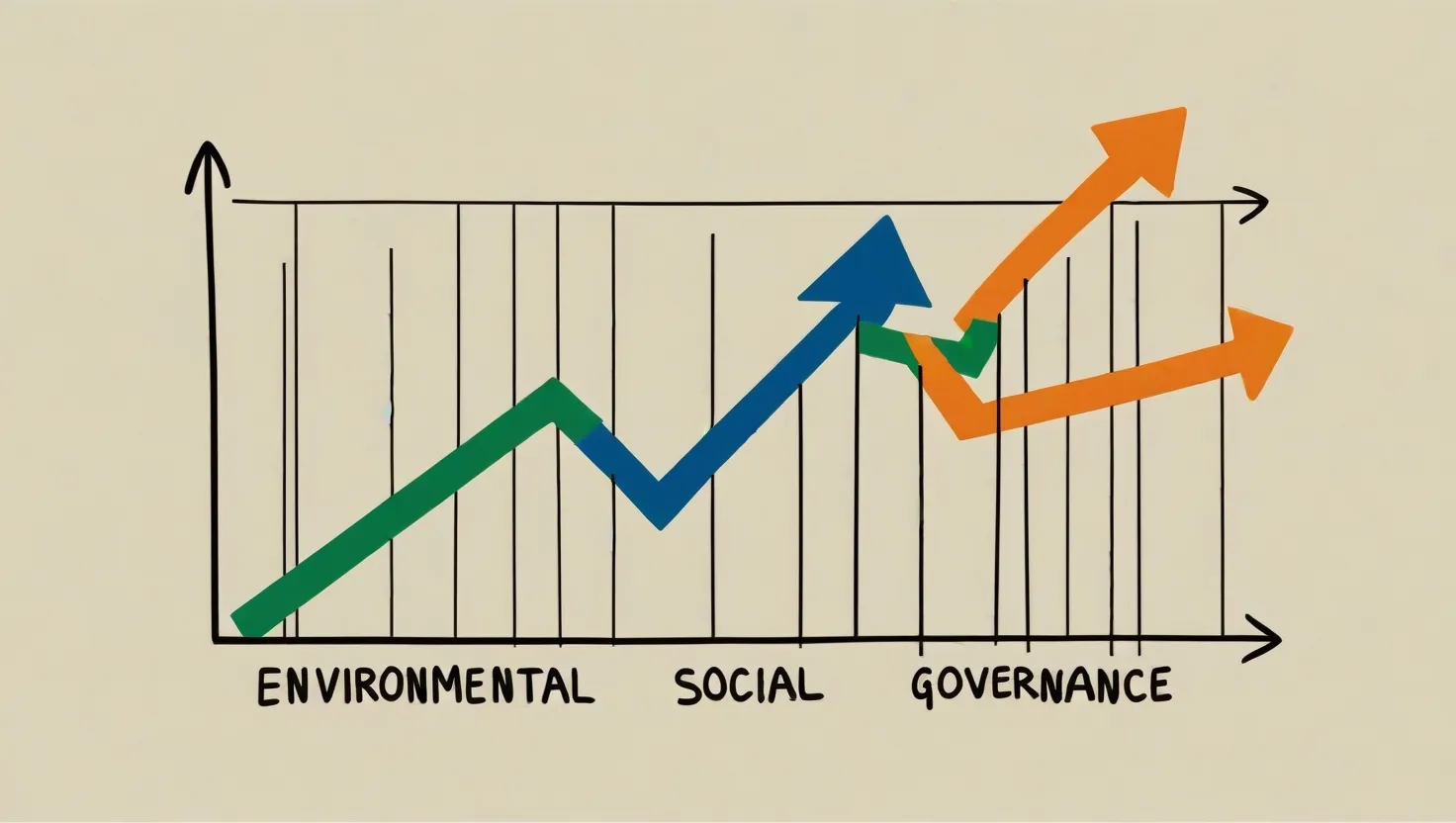

Cryptocurrencies add yet another twist. Promising decentralization and self-sovereign finance, they challenge the authority of traditional banks and governments. Blockchains make every transaction traceable, immutable, and public—at least in theory. Yet, these systems swing between hype and fear, their values rising and crashing on rumors, hacks, and regulatory crackdowns. Could these new currencies ever replace the old, or will they remain a niche—exciting to speculators, yet intimidating to ordinary users? How would you feel about keeping your life’s savings in a password-protected digital account, unreachable if you forget a phrase?

“Banking establishments are more dangerous than standing armies,” Thomas Jefferson once warned. His words echo today as big tech companies, not just banks, become dominant players in payments. Apple, Google, and countless start-ups vie to win our trust—handling not just our money, but our data, habits, and sometimes even our identities. Does this concentration of power in private hands reassure you, or give you pause?

Even as innovations pile up, older systems rarely disappear. Cheques persist for some payments, coins jingle in pockets, and cash remains king in many regions, especially in times of crisis or blackout. Digital divides mean that beneath the sheen of cashless convenience, many still transact in ways unchanged for generations. Payment methods coexist, overlap, and sometimes collide, reflecting both technological progress and real-world limitations.

Regulation lags behind technology, often struggling to balance innovation and oversight. New payment models—like central bank digital currencies (CBDCs)—are now being trialed, promising the speed of crypto with the stability of state backing. Will they tip the balance further toward convenience, or will they spark fresh debates about privacy and surveillance?

Looking back, what stands out is less the devices or currencies themselves, and more the persistent human quest to make exchanging value easier, safer, and more universal. What’s next—a payment chip implanted under the skin, or entirely invisible, voice-activated transactions? The only certainty is that payment systems will keep changing, shaped by creativity, necessity, and the deepest forms of trust.

“As money goes, so goes the world.” These words, attributed to many a philosopher and financier, remind us that our quest for smoother transactions mirrors our desire for stability and connection. Payment is, at its heart, a social contract—one that’s rewritten with every leap in technology.

So, the next time you tap a phone, swipe a card, or send a digital coin, consider how centuries of ingenuity have made that moment possible. What risks and promises will the next generation of payment systems bring? And most importantly—what role will you play in that unfolding story?