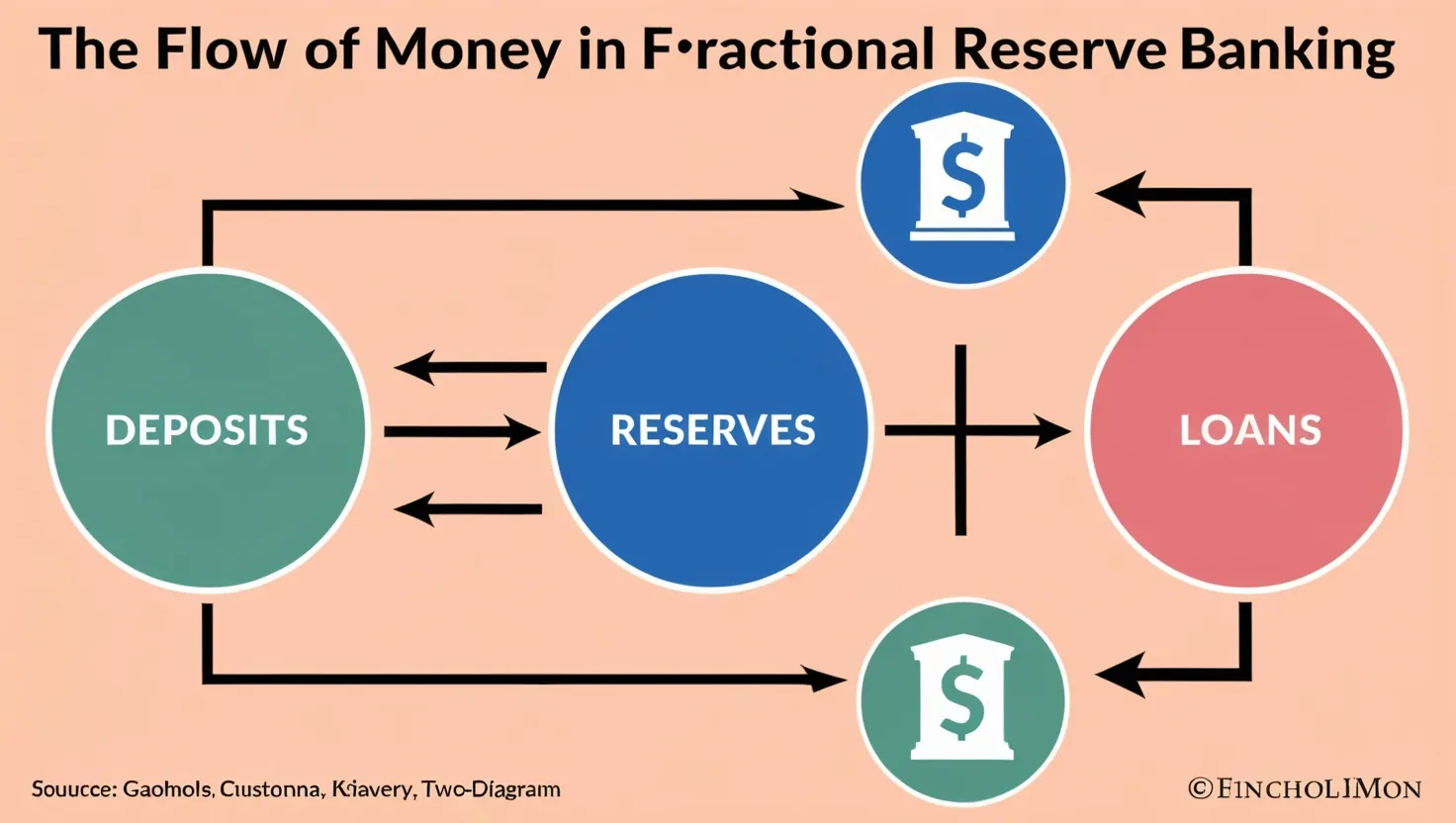

In the intricate world of modern finance, one concept stands out for its complexity and controversy: fractional reserve banking. This system, which is the foundation of how banks operate today, allows banks to lend out more money than they actually hold in deposits. To understand how this works and its far-reaching implications, let’s delve into the heart of fractional reserve banking and the money multiplier effect.

The Basics of Fractional Reserve Banking

Imagine you deposit $1,000 into your savings account. In a full reserve banking system, the bank would keep the entire $1,000 in its vault, ready for you to withdraw at any moment. However, in a fractional reserve system, the bank is only required to keep a fraction of that amount, say 10%, as reserves. This means the bank can lend out the remaining $900 to other customers.

This process might seem straightforward, but it has a profound impact on the money supply. When the bank lends out $900, that money is spent and eventually deposited into another bank. This new bank, in turn, can lend out a portion of that deposit, and so on. This cycle of lending and depositing creates a ripple effect that significantly expands the money supply.

The Money Multiplier Effect

The money multiplier is a key concept here. It measures how much the money supply can be increased through this cycle of lending and depositing. The formula for the money multiplier is simple: it is 1 divided by the reserve ratio. For example, if the reserve ratio is 10%, the money multiplier is 10. This means that for every $1 in new reserves, the banking system can create up to $10 in new money.

To illustrate this, consider the initial $1,000 deposit. The bank keeps $100 as reserves and lends out $900. The recipient of the $900 deposit then spends it, and the money is deposited into another bank. This second bank keeps $90 (10% of $900) and lends out $810. This process continues, with each bank lending out a portion of the deposits, creating a geometric series that results in a substantial increase in the money supply.

Implications on Money Creation and Inflation

The money multiplier effect is a powerful tool for expanding credit and stimulating economic growth. However, it also has significant drawbacks. One of the most critical issues is inflation. When the money supply increases rapidly, the value of each unit of currency decreases, leading to higher prices. This can erode the purchasing power of consumers and undermine financial stability.

Moreover, the system creates a perpetual risk of bank runs. Since banks only hold a fraction of deposits in reserves, they are vulnerable to a situation where a large number of depositors demand their money at the same time. If this happens, the bank may not have enough cash to meet the demand, leading to a collapse of the banking system.

Economic Stability and Central Bank Control

Central banks play a crucial role in managing the money supply through reserve requirements. By adjusting the reserve ratio, central banks can influence how much money banks can create. For instance, lowering the reserve ratio allows banks to lend more, which can stimulate economic growth during times of recession. However, this control is indirect and can be influenced by various factors, including the public’s preference for holding cash versus deposits and banks’ willingness to hold excess reserves.

In reality, the money multiplier is not always stable. Banks may choose to hold more reserves than required, especially during economic uncertainty. Additionally, the public’s behavior, such as holding more cash during recessions, can reduce the effectiveness of the money multiplier. This unpredictability makes it challenging for central banks to precisely control the money supply.

Alternative Banking Models

While fractional reserve banking is the dominant system globally, there are alternative models that have been proposed and implemented. Full reserve banking, for example, requires banks to hold 100% of deposits in reserves, eliminating the ability to create new money through lending. This system is more stable but can lead to less available and more expensive credit, as banks cannot generate revenue through lending.

Another alternative is the concept of narrow banking, where banks are restricted to holding only safe, liquid assets, such as government securities, and are not allowed to engage in risky lending activities. This model aims to reduce the risk of bank failures but may limit the availability of credit for economic growth.

The Future of Money in a Digital World

As the world becomes increasingly digital, the nature of money and banking is evolving. Digital currencies and blockchain technology are challenging traditional banking models. These innovations offer the potential for greater transparency, security, and efficiency in financial transactions.

However, they also raise new questions about the role of central banks and the control of the money supply. In a digital economy, the lines between traditional banking and new financial technologies are blurring. This shift could lead to new forms of fractional reserve banking or entirely new systems for money creation and management.

Conclusion

Fractional reserve banking and the money multiplier effect are fundamental to modern finance, enabling banks to create credit and stimulate economic growth. However, this system is not without its risks, including the potential for inflation and bank runs. As we move forward in an increasingly digital world, it is crucial to understand these mechanisms and their implications.

By exploring the intricacies of fractional reserve banking, we can better appreciate the complex interplay between banks, central banks, and the broader economy. This understanding is essential for navigating the challenges and opportunities of the financial world, ensuring that we can harness the benefits of credit expansion while mitigating its risks. In the end, it is this delicate balance that will shape the future of money and finance.