Finland is known for lots of unique things—like heavy metal bands and Nokia. Yes, Nokia—the mobile tech giant that employs over 100,000 people and makes billions each year. But have you ever wondered how it all began?

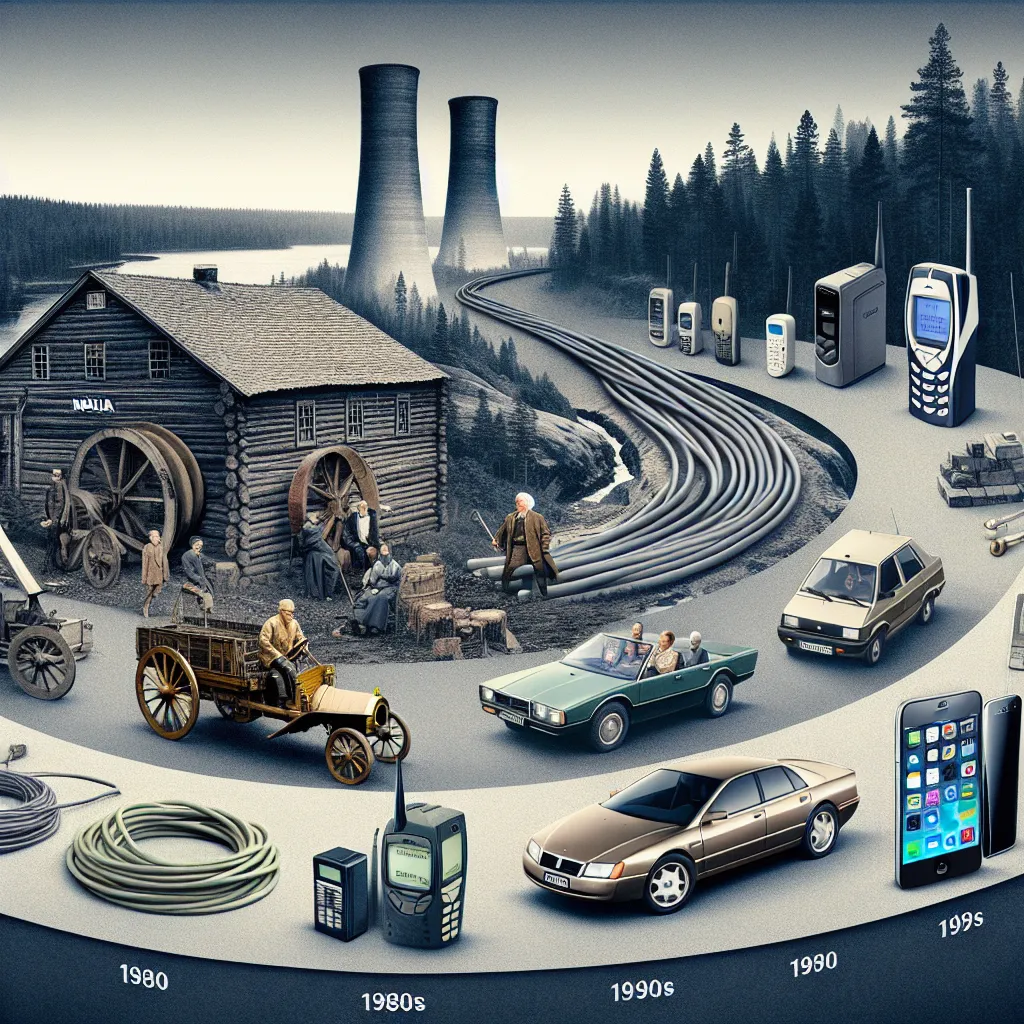

Let’s go back over 150 years. Frederik Idestam, seeing an opportunity, set up a paper mill in Finland due to its rich forests. Not long after, he built another paper mill near a town called Nokia, beside the Nokia River. Frederik soon partnered with Leo Mechelin, who had ambitious ideas. Together, they expanded into electricity. Meanwhile, Eduard Polón founded Finnish Rubber Works, making rubber goods like boots and tires. After WWI, Mechelin’s company wasn’t doing well and got absorbed by Finnish Rubber Works, which kept the electricity and paper businesses afloat.

In 1912, Finnish Cable Works was born, later joining the growing Nokia family. World War II brought huge opportunities as the Soviet Union needed to rebuild, creating massive demand for telephone and electrical cables. This influx of cash sparked new ventures across numerous industries, from TV production to plastic manufacturing.

The real game-changer happened in the ’70s when Nokia developed a digital switch for telephones, marking the start of their journey into telecom. By the late ’60s, Nokia was making radio phones for cars and the military. By ‘78, they covered Finland with their car phone system and, in alliance with TV-maker Salora, launched the world’s first cellular network, known then as the 1G system.

The 1980s saw Nokia release its first car phone, the Mobira Senator. It was bulky and hefty, but things improved with the Mobira Talkman, though it was still more fitted for cars. Then came the Mobira Cityman, weighing just 800 grams but costing a small fortune. When Soviet President Mikhail Gorbachev used it publicly, it became a status symbol, even earning the nickname “The Gorby.”

With the launch of the 2G GSM network in the late ’80s, Nokia shifted to digital signals, paving the way for SMS messaging. The first 2G call was made in 1991, and the first text message—“Merry Christmas”—soon followed.

Yet, Nokia hit financial bumps in the early ’90s, leading to a focus solely on telecom by selling off other divisions. This shift saw the birth of the Nokia 2100 series, which featured the iconic Nokia ringtone and the game Snake. The demand exceeded their wildest expectations, transitioning from an anticipated 400,000 units to over 20 million sold.

To keep up, Nokia revamped its supply chain, working closely with Finnish suppliers for technology and plastics. This strategy paid off big time, propelling Nokia to quintuple its revenue from 1996 to 2001 and making it the world’s largest mobile phone provider for 14 years.

But then came Apple. The iPhone’s launch in 2007, with its sleek design and multi-touch display, revolutionized the industry. Nokia’s plastic hardware couldn’t compete with Apple’s allure. The App Store further shifted tides. Nokia’s market share plummeted, and today, their stock has dropped over 90% from their peak era.

The lesson here? Never get too comfortable. Innovation can both make you and break you. Nokia’s initial innovations set them up for success, but their reluctance to evolve opened the door for Apple’s domination. The story of Nokia is a compelling reminder that staying ahead means never stopping the quest for improvement.