We live in an era of abundance. Unlike our ancestors who spent their days toiling for their food, today we’re just a click away from a world of culinary delights. But it’s curious to note that despite this diversity, the food industry is dominated by a handful of companies. Today, let’s dive into the story of the world’s largest food company, Nestle.

In 1866, two Swiss entrepreneurs separately embarked on their ventures. Charles Page, inspired by Switzerland’s lush meadows and robust cows, aimed to build a condensed milk factory. He envisioned his Anglo-Swiss Condensed Milk Company becoming the British Empire’s go-to supplier. At the same time, Henri Nestle, a German immigrant, was passionate about addressing Europe’s high infant mortality rate. He developed an affordable breast milk substitute, Farine Lactée, which rapidly became essential throughout Switzerland.

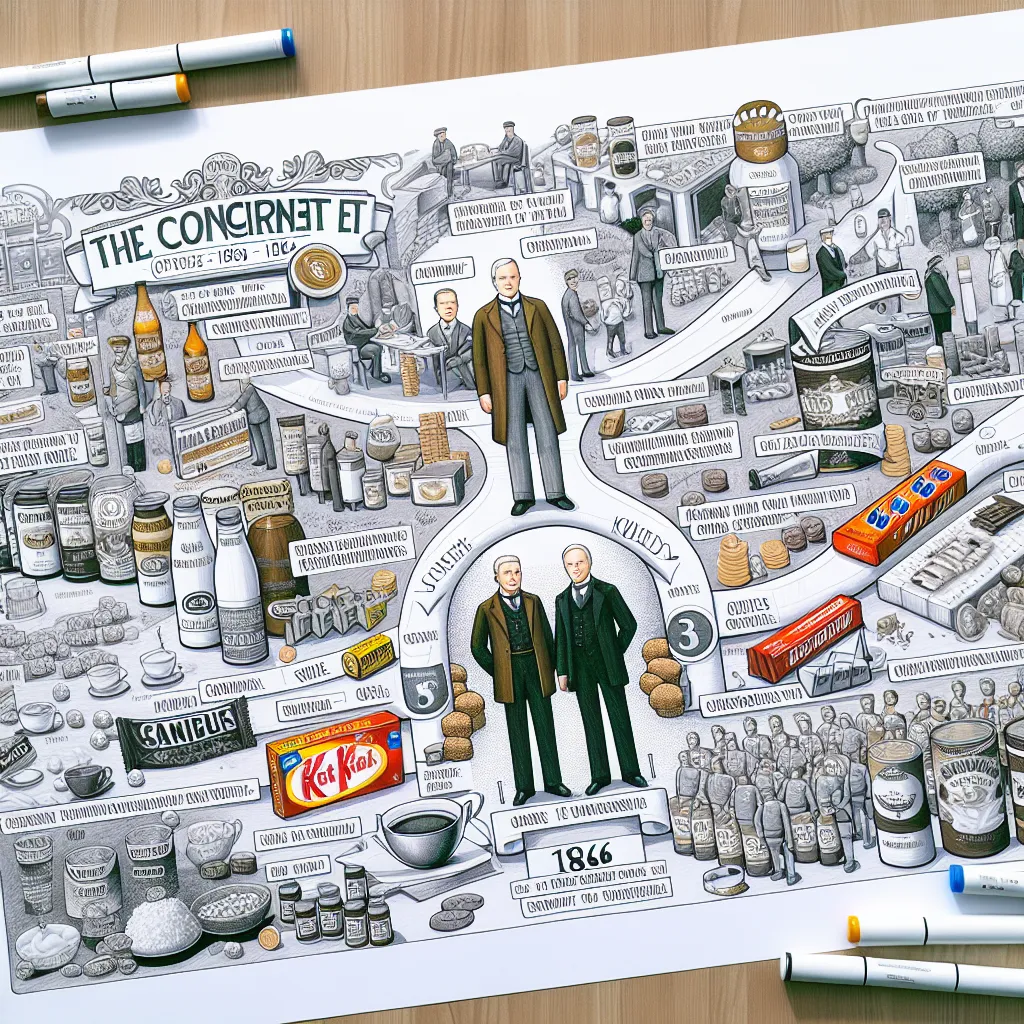

By 1871, Henri’s infant formula was a hit in Western Europe. His production grew from 1,000 cans a day to more than 2,000 by 1873. The rivalry began in 1877 when the Page brothers ventured into the infant formula market. Henri struck back by releasing Nestle-branded condensed milk, igniting a fierce price war that lasted nearly 30 years. After the founders passed away, their companies merged in 1905, forming a conglomerate with 20 factories. Nestle soon expanded worldwide.

World War I seemed beneficial initially as militaries valued canned milk. However, raw material shortages and embargoes hit hard. Nestle quickly adapted by acquiring factories in the US, doubling its capacity multiple times. This taught Nestle the value of diversification. By the 1930s, they had factories in Asia and Latin America, shielding them from the Great Depression and paving the way for Nescafe, a wildly popular coffee product born out of Brazil’s coffee surplus.

World War II felt like a repeat scenario. Demand soared, but supply issues arose. Again, the US entry into the war was a turning point, with Nescafe becoming a military staple. Post-war, Nestle thrived, acquiring smaller European companies and launching products like Maggi, Nestea, and Nesquik.

Nestle’s growth continued via acquisitions, branching into markets like frozen food and pharmaceuticals. Their 30% stake in L’Oreal in 1974 was a significant move. By the late ’70s, they faced backlash for dubious marketing of breastfeeding substitutes in developing countries, a controversy that simmers to this day.

The ’80s saw more acquisitions, including Friskies, KitKat, and the creation of Nespresso. In 1992, they dove into mineral water, eventually dominating the market. Yet, controversies followed. In 2002, Nestle’s debt demands from famine-stricken Ethiopia caused uproar. In 2005, the CEO’s remarks on water not being a human right sparked global outrage.

The cocoa industry, vital for Nestle’s chocolates, has been tainted by issues of child labor and trafficking. Despite lawsuits and boycotts, Nestle remains a powerhouse, owning over 2,000 brands globally. With the world’s enduring love for its products, Nestle’s future expansion seems inevitable.

If Nestle’s story intrigues you, there’s plenty more behind the scenes of other business giants. Stay curious and keep exploring these fascinating tales.