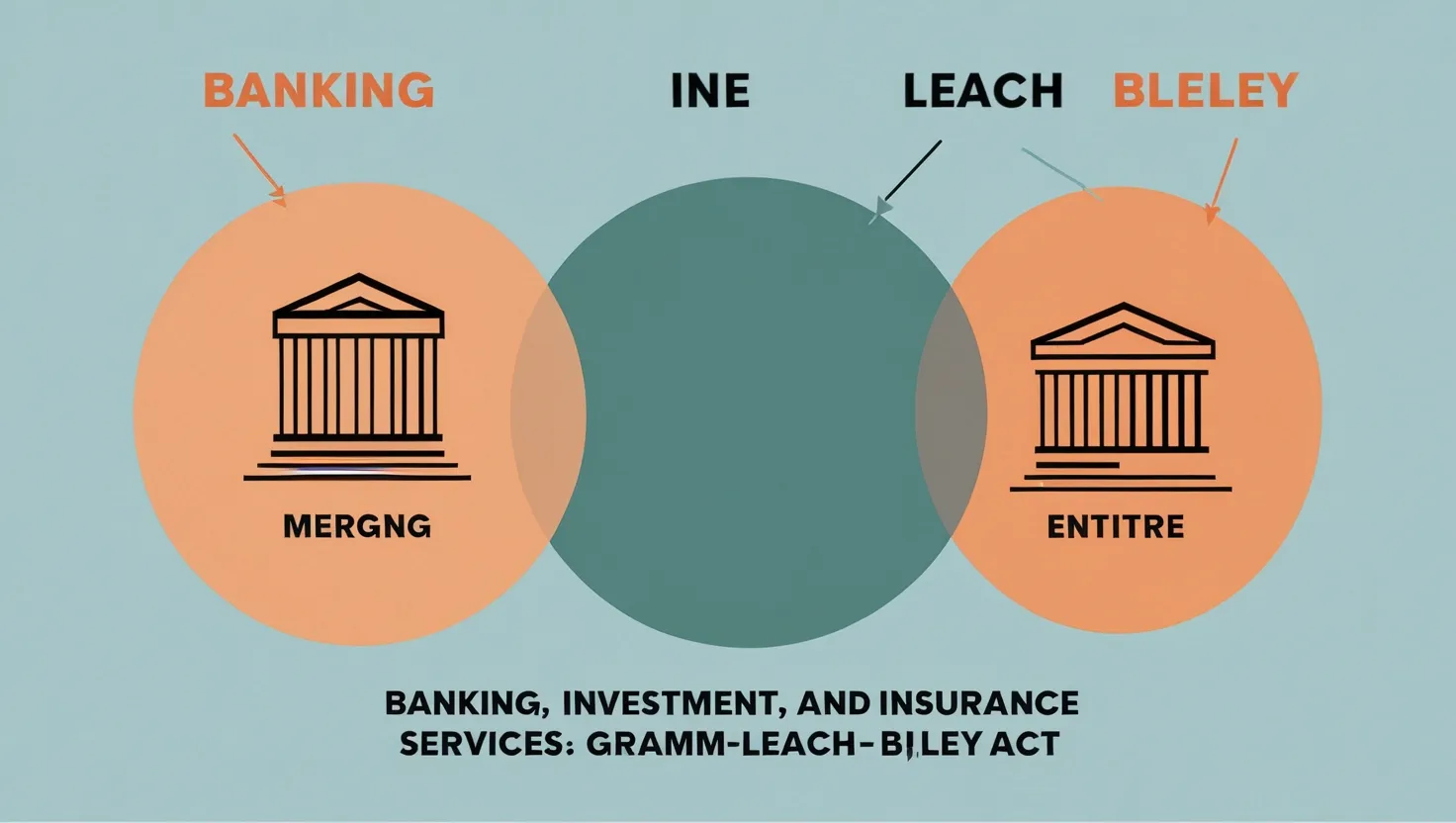

The Gramm-Leach-Bliley Act of 1999 was a watershed moment in the history of U.S. financial regulation, marking a significant departure from the stringent rules of the past. This legislation, often abbreviated as GLBA, repealed key provisions of the Glass-Steagall Act, a law that had been in place since the Great Depression. Glass-Steagall had strictly separated commercial banking, investment banking, and insurance activities, but GLBA changed the game by allowing these entities to merge and operate under a single umbrella.

The Birth of Financial Supermarkets

Proponents of the Gramm-Leach-Bliley Act argued that it would foster greater competition and efficiency in the financial sector. By allowing commercial banks, investment banks, and insurance companies to combine their operations, the act enabled the creation of what were dubbed “financial supermarkets.” These conglomerates could offer a wide array of financial services, from accepting deposits and making loans to underwriting securities and providing insurance.

As Warren Buffett once said, “Price is what you pay. Value is what you get.” In the context of GLBA, the value was supposed to be increased efficiency and a broader range of services for consumers. However, this integration also raised eyebrows among critics who warned of potential pitfalls.

Concerns Over Systemic Risk

Critics of the Gramm-Leach-Bliley Act were vocal about the risks it posed. They argued that by blurring the lines between different financial activities, the act could lead to increased systemic risk and conflicts of interest. For instance, if an investment bank’s risky trading activities were tied to a commercial bank’s insured deposits, it could put the entire financial system at risk.

These concerns were not mere speculation. During the 2008 financial crisis, the consequences of this deregulation became starkly apparent. The crisis was exacerbated by the complex web of financial instruments and the lack of clear regulatory oversight. As President Barack Obama later noted, “The failure of our financial system to protect consumers and investors led to a crisis that threatened the entire economy.”

Global Implications

The impact of the Gramm-Leach-Bliley Act was not confined to the United States. It had far-reaching implications for global financial trends and regulations. As financial institutions in the U.S. began to consolidate and expand their services, similar trends emerged in other countries. This led to a global debate about the appropriate level of financial regulation and the balance between innovation and stability.

In the aftermath of the 2008 crisis, many countries reevaluated their regulatory frameworks. Some moved towards more stringent regulations, while others continued to advocate for a lighter touch. This global discussion highlighted the complexities of financial regulation and the need for a nuanced approach that balances innovation with stability.

Legacy and Lessons

Today, the Gramm-Leach-Bliley Act’s legacy continues to shape discussions about financial regulation. Its effects serve as a case study in the potential consequences of deregulation and the challenges of adapting regulatory frameworks to evolving financial landscapes.

As we reflect on the act’s history and implications, several questions come to mind: What is the right balance between regulation and innovation? How can we ensure that financial institutions operate safely without stifling growth? These are not easy questions to answer, but they are crucial for policymakers and investors alike.

A Case for Balanced Regulation

The experience with GLBA underscores the importance of balanced regulation. While deregulation can foster innovation and efficiency, it must be accompanied by robust oversight mechanisms to mitigate risks. This balance is delicate and requires continuous monitoring and adjustment.

As Alan Greenspan, the former Chairman of the Federal Reserve, once said, “The true measure of a career is to be able to be content, even proud, that you succeeded through your own endeavors without leaving a trail of casualties in your wake.” In the context of financial regulation, this means creating a system that promotes growth while protecting the stability of the financial system.

Looking Forward

Understanding the Gramm-Leach-Bliley Act’s history and implications is essential for navigating today’s complex financial environment. As financial markets continue to evolve, policymakers must remain vigilant and adaptable. The act’s legacy serves as a reminder that financial regulation is not a static entity but a dynamic process that requires constant evaluation and adjustment.

In conclusion, the Gramm-Leach-Bliley Act was a significant turning point in financial regulation, with far-reaching consequences that are still being felt today. As we move forward, it is crucial to learn from the past and strive for a regulatory framework that balances innovation with stability, ensuring a safer and more resilient financial system for all.