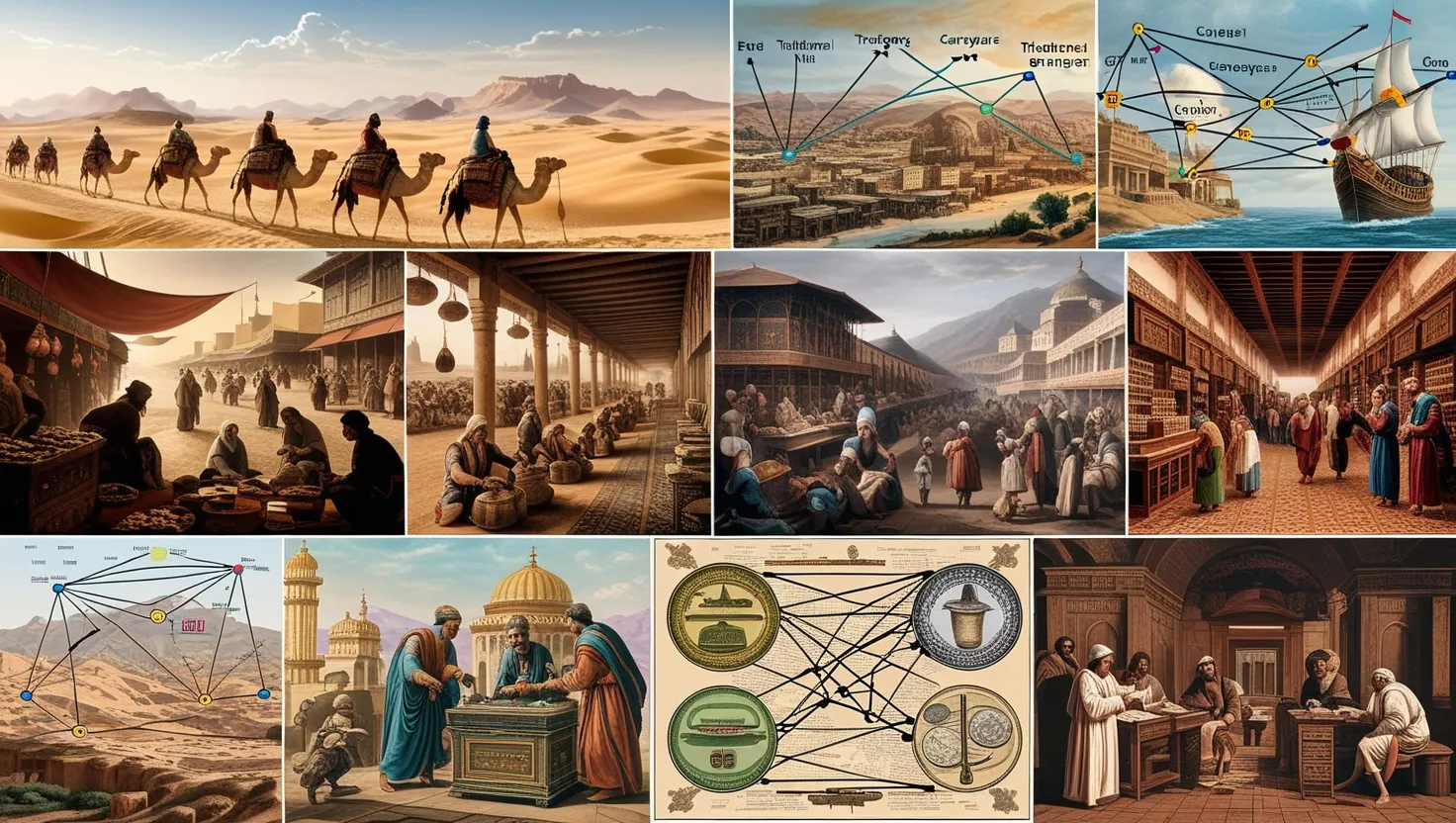

When I picture the Silk Road, I don’t just see camel caravans winding through deserts and high mountain passes. What stands out even more vividly is a web of trust, innovation, and risk—elements still at the heart of modern finance. The Silk Road may have physically faded from the map, but its legacy pulses in virtually every aspect of our global banking system.

It’s easy to forget how challenging long-distance trade was two thousand years ago. Imagine hauling silk, spices, or gold across thousands of miles, from China’s ancient capitals to bustling bazaars in Bukhara and Venice. You couldn’t just pack your valuables and hope for the best. There were language barriers, unreliable rulers, and bandits aplenty. That world forced traders to invent new ways to manage money, handle payments, and guarantee trust.

Take the hawala system, for example—a marvel of simplicity and trust. If you were a merchant in Samarkand needing to pay a supplier in Baghdad, carrying coin was hazardous. Hawala allowed you to “deposit” funds with an intermediary in your city. That agent would message his counterpart in Baghdad—no banknotes or coins had to travel. Your supplier received payment, and the agents settled balances later, sometimes months after the actual exchange. It was fast, trustworthy, and remarkably hard to intercept, even for powerful rulers who liked to control the flow of money.

What makes hawala so fascinating isn’t just its endurance; it’s that it flourished precisely because formal legal systems were weak or didn’t exist. Hawala worked because relationships mattered more than contracts. The power of reputation, family ties, and reciprocal obligation replaced what we now think of as institutional oversight. Has modern banking really moved that far beyond these roots, or do trust and personal networks still sit at the core, despite all our technology and regulation?

“If you want to go fast, go alone. If you want to go far, go together.”

— African Proverb

Now, let’s talk about letters of credit—another Silk Road invention that changed global business. These documents let merchants buy goods far from home without paying upfront in hard currency. Instead, a letter from a reputable financier promised payment to the supplier once the goods were delivered and inspected. On a practical level, it meant less cash was needed for each transaction, making fraud and theft less likely.

But the real genius behind letters of credit was in bridging vastly different legal, linguistic, and cultural worlds. They forced bankers and merchants to create standards for identity verification and to find ways to resolve disputes quickly—systems that international banks still use. Every letter of credit was a small act of diplomacy. People who had never met, and who might not even share a language, learned to trust a neutral intermediary’s promise.

Ever wondered why we trust plastic cards or online payment apps so much today? It’s because we inherited these methods of verifying identity, tracking obligations, and resolving conflict from the Silk Road era. Letters of credit may not fill headlines, but they work quietly in the background, making possible nearly every international trade deal.

Currency exchange is another area where Silk Road traders showed impressive creativity. The route itself wasn’t a single road but a mesh of countless trade arteries, each crossing regions with their own coins and standards. Imagine the job of a money changer: it wasn’t just counting coins, but also inspecting metal purity and weighing them with precision scales. Political turmoil, changing dynasties, and dramatic shifts in the value of gold or silver meant that rates had to be set carefully and constantly.

What’s not so obvious is that some of these money changers doubled as early bankers. In some Silk Road hubs, entire families built networks that could transfer money, fund caravans, and even extend loans. They knew which currencies to trust and which ones to avoid. They understood supply and demand, and could sense when a new route or political alliance would change the flow of goods—and thus the value of money.

“In the middle of difficulty lies opportunity.”

— Albert Einstein

I’ve always found it fascinating that the Silk Road also served as a laboratory for paper money. China may have had some of the first printed bills, but it was the bustling markets connecting Asia to the Mediterranean that demonstrated their true power. Paper money, unlike heavy coins, traveled well, a vital advantage for anyone braving deserts and mountains. These early “drafts” were called “flying money”—a poetic name for a practical solution.

By experimenting with promissory notes, drafts, and tally sticks, traders developed portable, flexible payment systems. So much so that, by the time Marco Polo journeyed east, he marveled at the sophistication of Chinese banking and paper currency. It’s a reminder that many financial solutions we now take for granted took shape not in modern capitals, but in dusty caravanserais and lively Silk Road markets.

Have you ever thought about the personal side of risk in these ventures? When plagues broke out or empires collapsed, fortunes could vanish overnight. Yet the most adaptable merchants didn’t simply gamble everything on one product or route. They diversified—across regions, goods, and even political allegiances. This strategy is just as relevant in today’s volatile markets. Any investor who spreads risk, or a company that serves multiple international markets, owes something to these early survival lessons.

Then there’s the matter of how Silk Road finance transformed with the times. When overland routes became dangerous—remember the Black Death and the Mongol invasions—some of the families running these financial networks shifted their efforts toward maritime trade. Their knowledge, methods, and connections set the stage for the rise of Venice, Genoa, and the great European banking dynasties.

Ask yourself: could our modern banking empires have taken root so quickly if these earlier networks hadn’t experimented with every kind of credit, insurance, and risk mitigation? The answer, I suspect, is no. Even now, the ability to adapt—to new routes, new technologies, and new regulations—remains a hallmark of financial resilience.

Think for a moment about today’s world. Cross-border trust issues, fluctuating currencies, political risk—none of these challenges are new. The very tools invented by Silk Road traders—like robust credit systems, trusted intermediaries, and flexible payment methods—helped create the foundation for today’s financial globalization. Even hawala, that ancient network of trust-based money transfers, continues to thrive in parts of Asia, Africa, and the Middle East. It quietly serves millions, especially where formal banks may be absent or unreliable.

“Fortune favors the bold.”

— Virgil

What can I learn from this history as someone living in a hyper-connected, digital era? First, it’s that financial innovation thrives where necessity is greatest. When borders are porous and law enforcement is scattered, trust networks matter more than any legal code. Second, adaptability is everything. Those who survived the shifting sands of Silk Road commerce did so by watching for change—by listening, learning, and evolving ahead of their competition.

There’s also something deeply human about the way Silk Road finance evolved. Everything depended on people being able to read subtle signals, form partnerships, and keep good records—skills we still value, even if the technology has changed. True, today algorithms help determine market trends and risk, but behind every breakthrough in fintech or global banking, the same basic needs persist: trust, adaptability, and the courage to cross divides.

Sometimes I wonder what the great merchants and bankers of Samarkand, Damascus, or Venice might think of our world of instant payments and global trading platforms. Would they marvel at the speed, or warn us about the risks of forgetting the lessons they learned with such effort? What’s certain is that the DNA of our banking system—even blockchain and digital currencies—can be traced straight back to the financial innovations of the Silk Road.

“To know the road ahead, ask those coming back.”

— Chinese Proverb

If you’re ever tempted to shrug off ancient history as irrelevant, remember that the shape of every wire transfer, the structure of every contingent liability, and the logic behind international regulations have roots in solutions devised by those who trudged across the Silk Road. The problems they faced—safe transfer of value, reliable credit, smart adaptation—still define the faults and successes of our financial system.

So next time you tap your phone to send money, recall how long these ideas have been in motion. You’re participating in a story that began millennia ago, shaped by people who risked everything to make commerce possible over impossible distances. Their legacy isn’t just history—it’s alive every time we trust a transaction to happen, sight unseen, across borders and cultures.

Would you have trusted your fortune to a network of strangers, bound only by honor and reputation? On some level, aren’t we all doing just that today?