Microcredit Revolution: How Small Loans Transform Lives and Economies Worldwide

Discover how microcredit transformed global poverty alleviation, from Muhammad Yunus's $27 loan to worldwide financial inclusion. Learn the impacts, challenges, and future of this revolutionary economic model. Join the conversation today.

The Evolution of Federal Reserve Independence: Balancing Political Pressure and Economic Stability

Discover how the Federal Reserve gained independence through key historical moments, from the 1951 Accord to modern challenges. Learn why central bank autonomy matters for economic stability and future policy decisions. #MonetaryPolicy #Economics

Sovereign Debt Crises: Global Financial History from Spain to Modern Defaults

Learn from centuries of sovereign debt crises that shaped global finance. Discover patterns from Philip II to modern defaults, and explore how history informs today's economic challenges. Gain insights for navigating future financial storms.

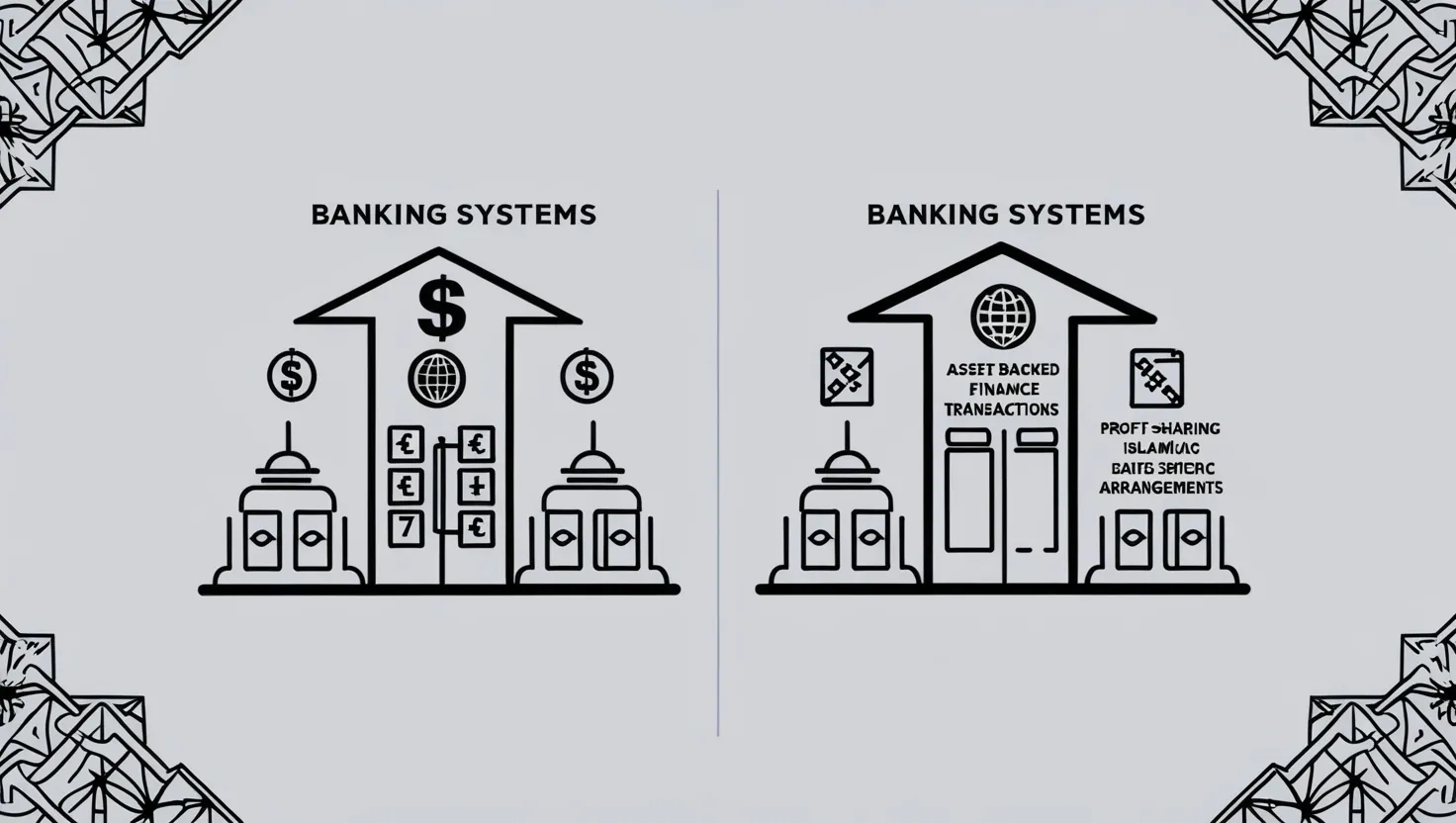

Islamic Banking: How Sharia-Compliant Finance Works in Modern Economy

Discover how Islamic banking combines religious principles with modern finance to create a $2T ethical alternative to conventional banking. Learn about interest-free instruments and why this system weathered the 2008 crisis better than most. #IslamicFinance

Japan's Post-War Economic Miracle: Lessons for Modern Development and Recovery

Discover how Japan transformed from war-torn nation to economic giant in decades. Learn key strategies behind the Japanese Economic Miracle and their relevance for modern development. Read now for crucial insights on recovery and growth.

The 1973 OPEC Oil Embargo: How Global Finance Changed Forever

Learn how the 1973 OPEC oil embargo transformed global finance and energy markets. Discover its lasting impact on petrodollar systems, financial innovations, and economic policies that shape today's world economy.

Behavioral Finance: How Psychology Shapes Market Dynamics

Discover how behavioral finance challenges traditional economic theory. Learn about cognitive biases and emotional factors shaping financial decisions. Improve your investment strategies now.

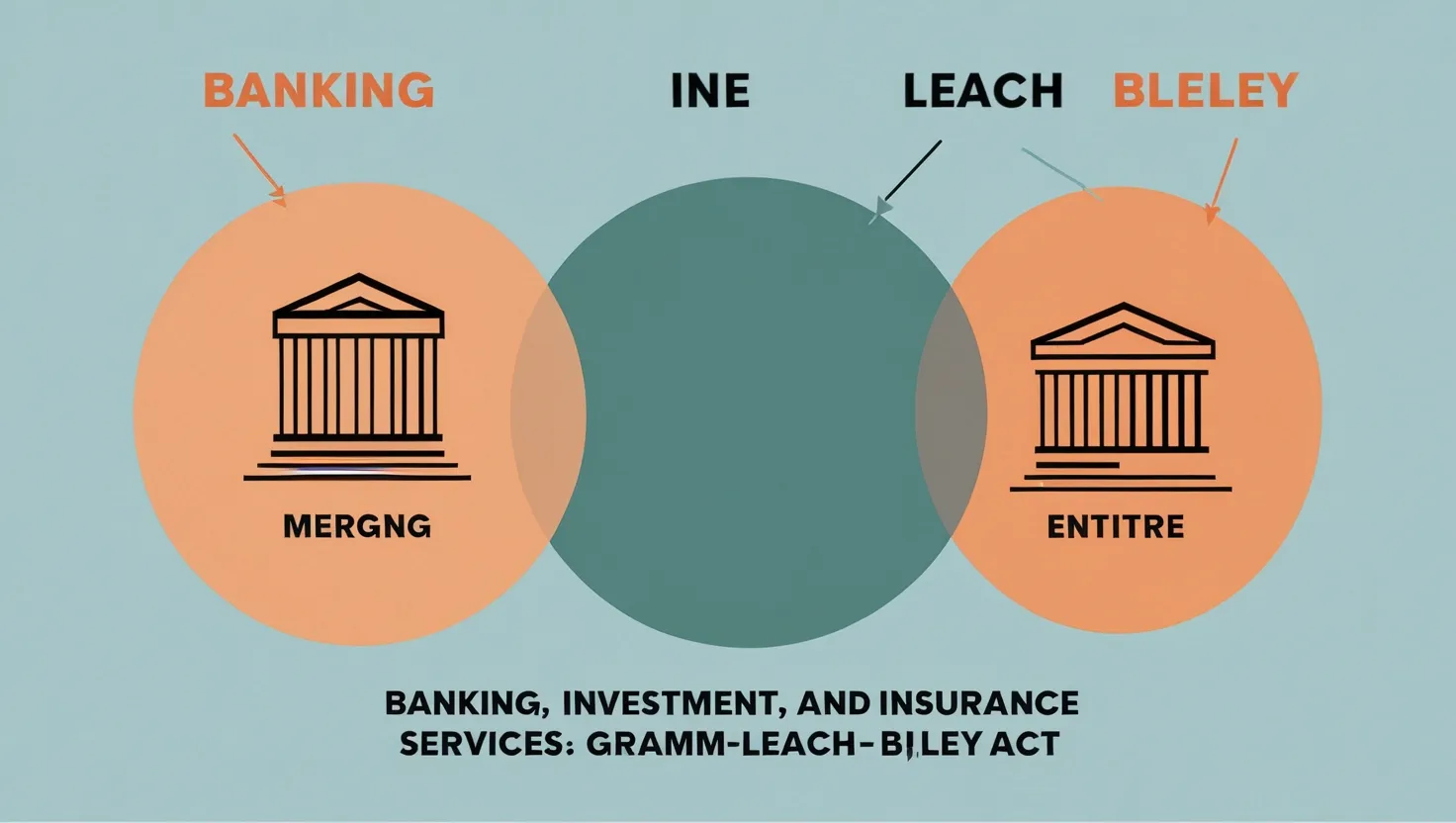

Gramm-Leach-Bliley Act: Reshaping Financial Regulation and Its Lasting Impact

Explore the Gramm-Leach-Bliley Act's impact on financial regulation. Learn how it reshaped banking, increased systemic risks, and influenced global trends. Discover key lessons for future policy.

Sovereign Wealth Funds: Shaping Global Finance and Economic Power

Discover the power of sovereign wealth funds in shaping global finance. Learn their strategies, impact, and future role in economic development. Explore now.

Central Banking Evolution: From Gold Standard to Digital Age

Explore the evolution of central banking from its origins to modern challenges. Learn how monetary policies shaped economic stability and what the future holds. Read now.

The Dot-Com Bubble: 5 Crucial Lessons for Modern Tech Investors

Discover the lasting impact of the dot-com bubble and its relevance today. Learn key lessons for modern tech investors and how to balance innovation with prudent decision-making. Read now.

The Bretton Woods System: Shaping Global Finance in the Post-War Era

Discover the impact of the Bretton Woods System on global finance. Learn how this post-WWII economic order shaped international cooperation and stability. Explore its legacy today.

The Rise of ESG Investing: Balancing Profit and Purpose in Modern Finance

Discover the evolution of ESG investing and its impact on financial markets. Learn how balancing profit with purpose is transforming corporate responsibility and investment strategies. Explore the future of sustainable finance.