The Gold Standard's Legacy: How It Shapes Modern Monetary Policy

Discover the gold standard's lasting impact on modern monetary policy. Learn how its stability and rigidity shaped today's economic strategies. Explore the balance between discipline and flexibility.

The Volcker Rule: Reshaping Banking After the 2008 Crisis

Discover how the Volcker Rule reshaped banking after the 2008 crisis. Learn about its impact on proprietary trading, risk management, and financial stability. Explore the evolution of bank regulation.

The Index Fund Revolution: How Passive Investing Transformed Finance

Discover how passive investing revolutionized finance. Learn about index funds, their benefits, and impact on the market. Explore the future of low-cost, efficient investing strategies.

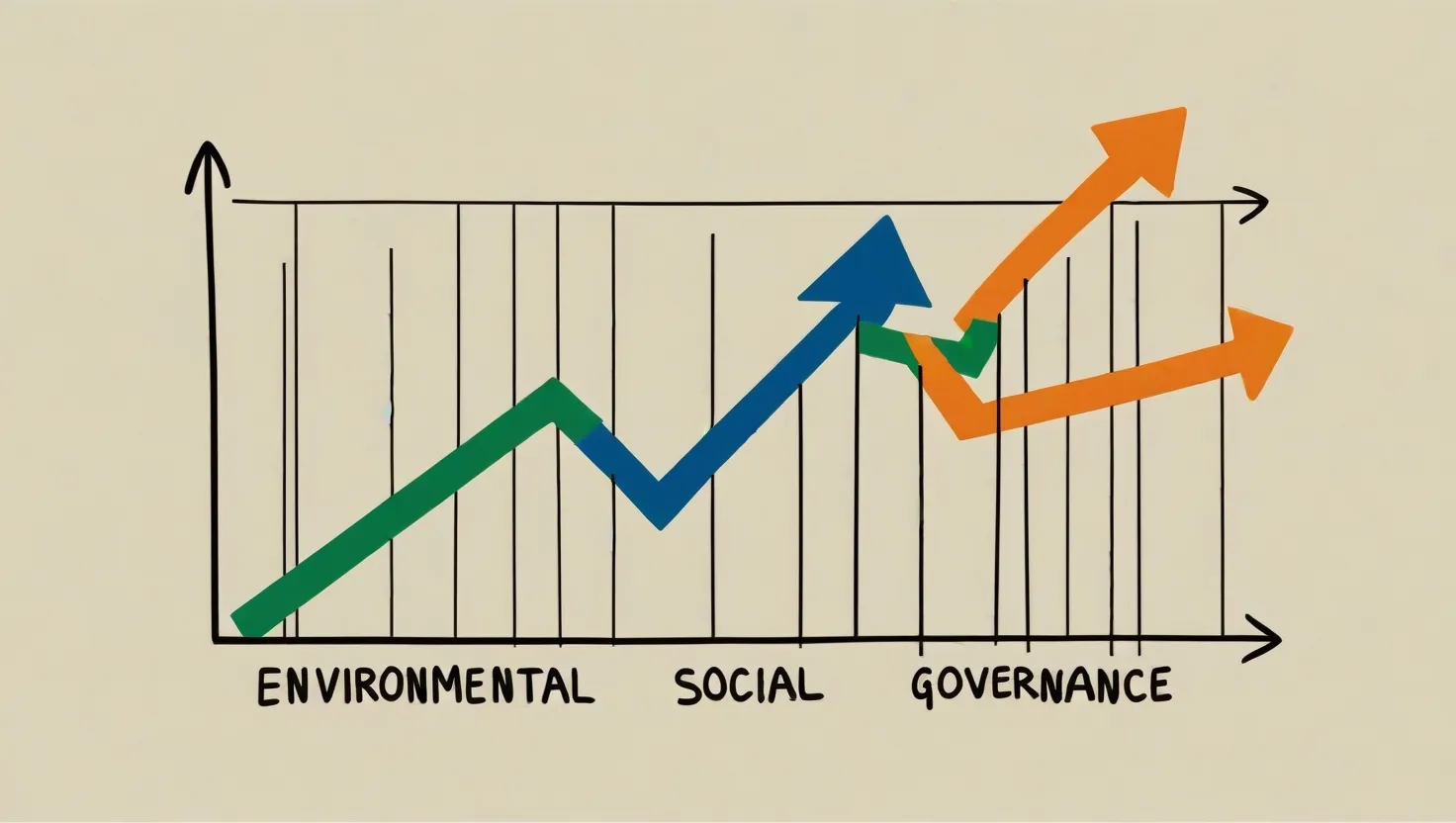

ESG Investing in 2024: Shaping the Future of Finance and Sustainability

Discover the impact of ESG investing in 2024. Learn how sustainability shapes financial decisions, corporate behavior, and global policies. Explore the future of sustainable finance.

Regenerative Finance: The Game-Changing Approach to Sustainable Investing and Earth's Future

Regenerative finance: Investing for environmental restoration and social impact. Explore how ReFi combines tech, agriculture, and finance to build a sustainable future.

Unlock Your Perfect Diet: DNA-Based Nutrition Revolutionizes Health and Wellness

Discover personalized nutrition through DNA testing. Learn how genetic insights can optimize your diet, prevent diseases, and improve overall health. Click for more.

Halal Investing: Ethical Wealth Building That Aligns Faith and Finance

Discover ethical finance with halal investing. Align your investments with Islamic principles, promoting fairness and social responsibility while seeking profitable opportunities.

Glowing Bacteria: The Tiny Superheroes Revolutionizing Medicine and Saving Lives

Discover how glowing bacteria are transforming medical research, from disease detection to targeted therapies. Explore the future of bioluminescence in healthcare.

Laughter Yoga: The Surprising Workout That's Making Millions Happier and Healthier

Discover Laughter Yoga: Boost health, reduce stress, and find joy through laughter exercises. Join a global movement of wellness and connection. Try it today!

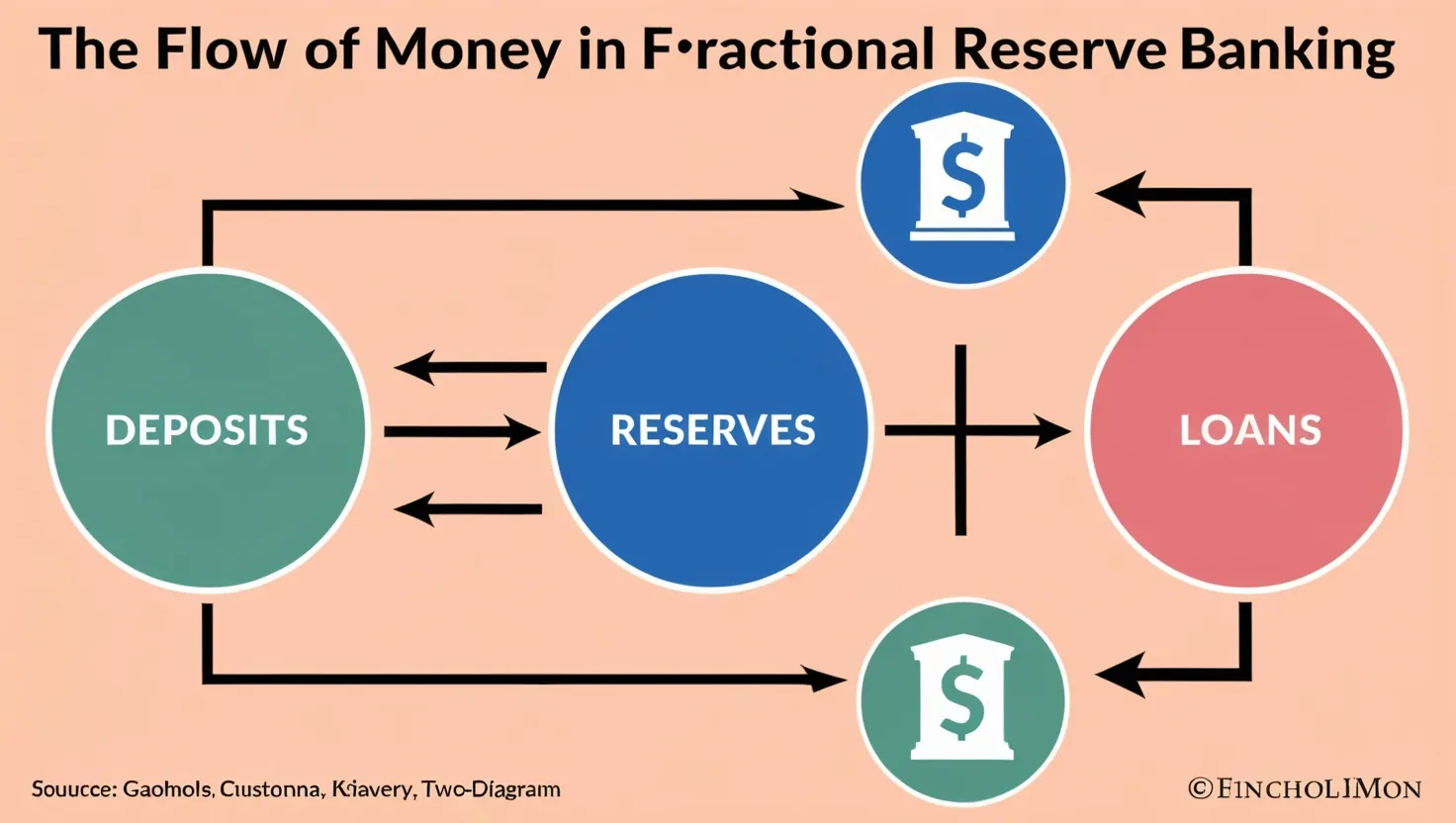

The Money Magic: How Banks Create Cash from Thin Air

Fractional reserve banking explained: How banks create money, its impact on the economy, and alternatives in the digital age. Explore risks and benefits.

Betting on Tomorrow: Synthetic Futures Markets Reshape Predictions and Policy

Synthetic futures markets let people trade on future event outcomes, from elections to pandemics. They tap into collective wisdom, providing insights for analysts and policymakers. These markets offer risk management tools and help study human behavior in complex systems. While raising ethical questions, they aggregate information and aid decision-making across various fields, leveraging crowd intelligence to forecast probabilities.

Circular Debt Crisis: How It's Crippling Energy Sectors and Economies Worldwide

Circular debt in the energy sector, especially in developing countries, occurs when power companies can't pay suppliers due to unpaid consumer bills and inadequate subsidies. This creates a cycle affecting the entire system. Causes include mismatched costs and revenues, inefficient distribution, and reliance on imported fuel. It impacts energy production, deters investors, and hinders economic growth. Solutions involve debt reduction plans, renewable energy transition, and improved governance.

Survive Hyperinflation: 7 Surprising Ways to Protect Your Money Now

Hyperinflation protection strategies include investing in unusual assets like art and wine, using cryptocurrencies, international diversification, and REITs. Advanced tactics involve TIPS, inflation swaps, and linked bonds. Historical examples show adaptations like using alternative currencies. Current hotspots drive financial innovation, impacting global economic stability. Combining traditional and unconventional methods is key to safeguarding wealth during economic turmoil.