In the vast and often disparate worlds of finance and faith, there exists a fascinating intersection that is gaining attention from both tech-savvy investors and spiritual seekers. This intersection is where ancient religious texts and modern stock market algorithms meet, creating a unique synergy that blends metaphoric wisdom with data-driven strategies.

To understand this synergy, let’s start with the concept of faith-based investing. This approach is not about buying stocks in religious organizations, but rather about aligning investment decisions with one’s religious values. For instance, a Christian investor might avoid companies involved in tobacco, adult entertainment, or gambling, opting instead for investments that reflect biblical principles. Similarly, Jewish investors often follow the Talmud’s guidance on philanthropy and diversification, incorporating socially responsible investing into their strategies.

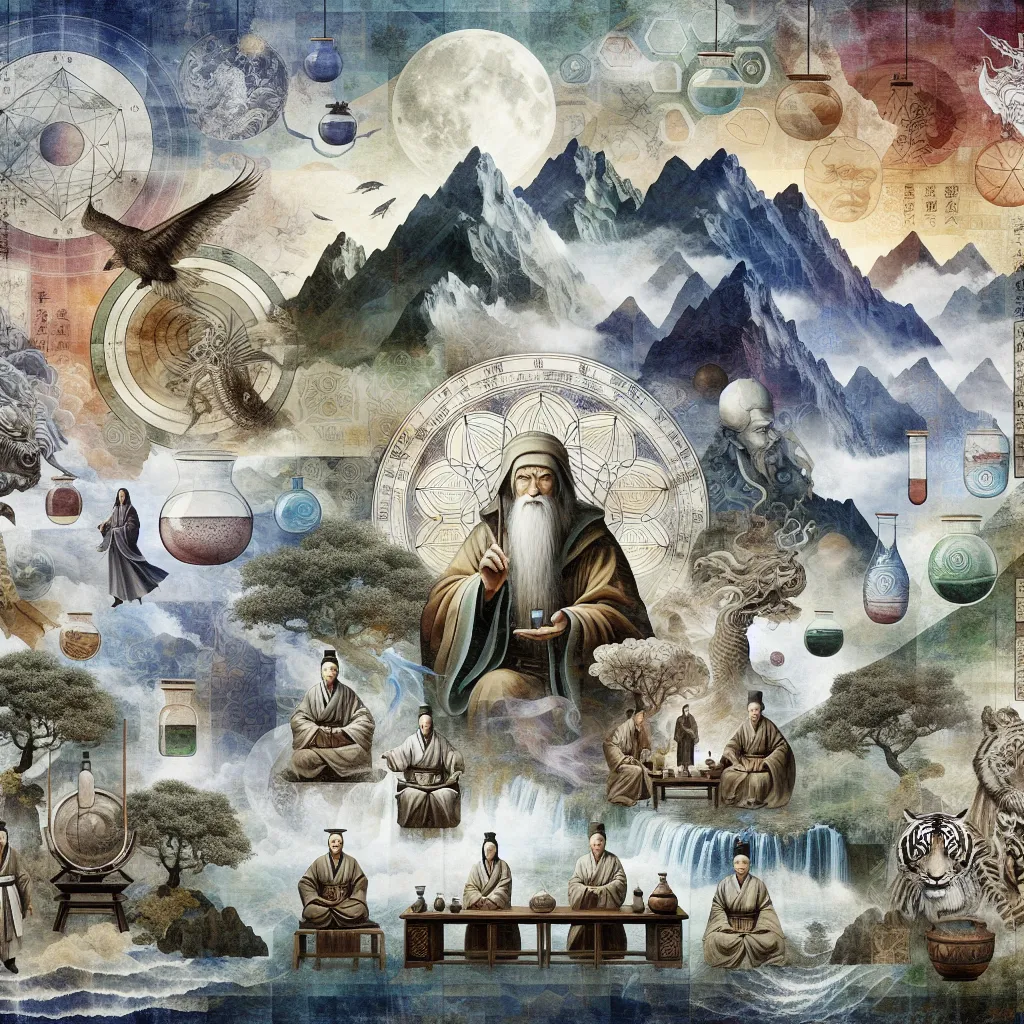

However, the connection between faith and finance goes beyond simple ethical guidelines. It delves into the deeper, more philosophical aspects of religious texts. Consider the idea of “God algorithms” – a term that might seem oxymoronic at first but holds significant insight. In many religions, followers often seek to reduce the complexities of divine interaction into a set of rules or formulas. For example, if one follows a certain set of commandments or rituals, they might expect a specific outcome, much like how an algorithm processes inputs to produce a predictable result.

This quest for a “God algorithm” mirrors the way algorithmic trading operates in the financial world. Here, sophisticated mathematical models and automated trading instructions aim to predict market behaviors and optimize trading decisions. Yet, just as religious texts caution against reducing the divine to simple formulas, the financial world is learning that algorithms, no matter how advanced, cannot fully capture the nuances of human behavior or the unpredictability of markets.

One of the most intriguing aspects of this synergy is how investors are drawing parallels between spiritual teachings and algorithmic inputs. For example, the concept of “detachment” in Buddhist teachings can be seen as analogous to the principle of risk management in trading. A Buddhist investor might view market fluctuations with a sense of detachment, avoiding emotional reactions that could cloud their judgment. Similarly, the Christian concept of “stewardship” can guide investors to manage their resources responsibly, aligning their trading strategies with long-term ethical considerations.

In the realm of algorithmic trading, strategies like trend following and mean reversion are akin to the cyclical nature of many religious teachings. Just as these algorithms identify patterns in market data to predict future trends, religious texts often describe cycles of prosperity and hardship, teaching followers to prepare for and respond to these cycles wisely. For instance, the biblical concept of the “seven years of plenty” followed by “seven years of famine” can be seen as a metaphor for market cycles, encouraging investors to diversify and prepare for both good and bad times.

The integration of faith-based insights into trading algorithms is also reflected in the way some investors approach decision-making. Instead of relying solely on data and models, they incorporate ethical and moral considerations into their strategies. This approach is not about predicting market movements with absolute certainty but about making informed decisions that align with their values.

For instance, an investor who follows Islamic principles might avoid investments in companies that deal with usury or other prohibited activities. This ethical filter can lead to a more stable and responsible investment portfolio, as it avoids sectors that are inherently risky or unethical. Similarly, a Hindu investor might follow the principle of “dharma” – or righteous living – in their investment choices, opting for companies that contribute positively to society and the environment.

This fusion of spirituality and technology is not just about personal conviction; it also has broader implications for the financial markets. By incorporating ethical and moral guidelines into trading algorithms, investors can contribute to a more stable and equitable market environment. For example, socially responsible investing, which is often guided by religious principles, can lead to better corporate governance and more sustainable business practices.

Moreover, this synergy can influence the collective consciousness of economic foresight. As more investors begin to see the value in aligning their financial decisions with their spiritual beliefs, there is a growing recognition that economic activities are not isolated from moral and ethical considerations. This shift in perspective can lead to a more holistic approach to finance, one that balances profit with purpose and responsibility.

In my own journey through the world of finance and faith, I’ve encountered numerous stories of investors who have found a deeper sense of purpose and fulfillment by integrating their spiritual beliefs into their investment strategies. There’s the story of a tech entrepreneur who, after a spiritual awakening, decided to invest only in companies that aligned with his new-found values. He found that this approach not only brought him peace of mind but also led to more sustainable and profitable investments.

Another example is a group of investors who formed a faith-based investment club, where they discuss and decide on investments based on a shared set of ethical and moral principles. This collective approach has not only strengthened their community bonds but also led to more informed and responsible investment decisions.

In conclusion, the synergy between faith and formulas is a powerful and evolving field that offers a fresh lens on how financial markets can be influenced by spiritual teachings. As we navigate the complex and often unpredictable world of finance, integrating metaphoric wisdom from ancient religious texts into our trading strategies can provide a unique edge. It’s a journey that suggests an unexpected harmony between the spiritual and financial worlds, one that can lead to more responsible, sustainable, and fulfilling investment practices.

This harmony is not about reducing the divine to simple algorithms or predicting market movements with absolute certainty. It’s about recognizing that our financial decisions are part of a larger tapestry that includes our values, beliefs, and responsibilities. As we continue to explore this intersection, we may find that the wisdom of the ages can indeed inform and enrich our modern financial endeavors, creating a more balanced and equitable economic landscape for all.